Oil finally got to 40. Now what? I will say, that if it can hang around the 40 level and builds a base, it could get to 45, but I still think that could be a stretch. Anyway, the market likes higher oil, regardless of the reason, because it implies…..a better economy??? I beg to differ on that, but ours is not to reason why.

Many of the indexes are at different points of resistance here, but resistance areas just the same.

The miners (GDX) hit some resistance and back off hard today after the great run.

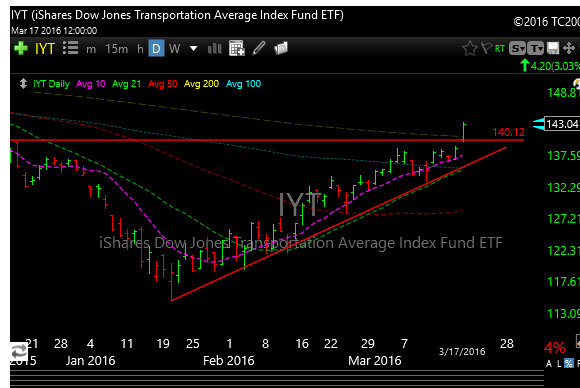

The transports finally broke out (IYT)

Biotech (IBB) still sucks. It came real close to the 240 area I was looking at,today but we’ll just have to see at this point. Broken for now.

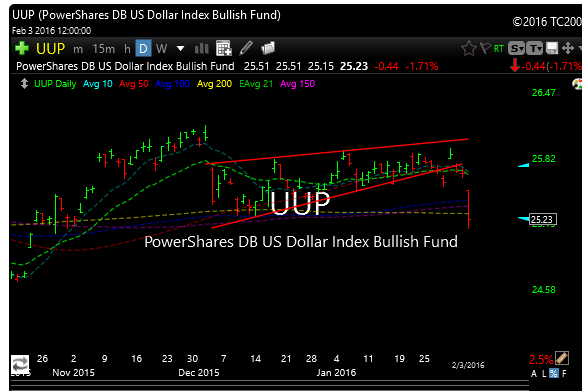

And Queen Dollar died again. This is good for commodities.

My takeaway is that hedge funds are batting 0 for 1000. They have had a horrific 2014, and 2015 is lousy for them as well. As a result, I think performance chasing into the end of the first quarter (just 2 weeks away), could play big as FOMO kicks in to overdrive. We’ll see.

Something to be aware of.

The period from last Friday through Wednesday marks the lowest daily volume average since the four-day period ending Jan. 5, which overlapped with the beginning of this year’s sharp selloff.

Today I added YRD and ASHR as longs to the P&L. AGQ also triggered.

See you in the morning.

Joe