-Leonardo Fibbonachi

For those of you have followed me into war for years now, you know I have my own bag of tricks and have never talked about Fibbonachi retracements. Leonardo was a medieval mathematician who was considered by many to be wicked assed smart.

I have no real horse in the race at this point, but I did want to point out that the SPX, which has rallied about 180 points off the lows has now retraced about 61.8% of the selloff from the 2100 level. 2001.33 to be exact. What does this mean? Maybe nothing, it can go higher but it would be a natural place to take some profits.

HOWEVER, that is just the SPX. We are seeing other places to make money, and many groups are oversold, building bases and have improving charts. Oddly, as you may know by now, they are in the most heinous sectors like oil and…wait for it…..coal.

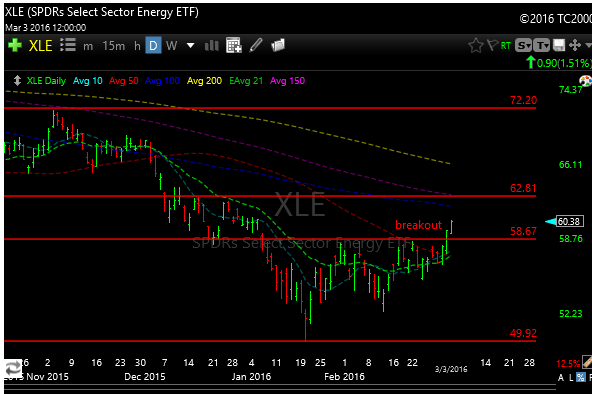

Two sectors that have clearly broken out of 2-3 month bases this week were OIH and XLE. Charts below. I would like to see more volume, but hey, wouldn’t everybody.

XLE

OIH

The two sectors “appear” to have some substance, so I have mentioned them here tonight.

….and check this out. How about coal? BTU and CNX both had big percentage days today on off the chain volume. These were going bankrupt two month ago, now traders are losing kidneys as they jump all over each other to buy. This can be typical reversal sentiment.

BTU-closed above 21 day moving average and at its huge downtrend kine. Maybe a 5 target. I’m still short a little from 17, guess I’ll cover tomorrow.

CNX (has gas & coal….has UNG bottomed?) Maybe a 12 target

I’ve seen moves like this before, and they fizzled, but you have to ask yourself if these beaten down disasters haven’t had their own capitulations. Is it the start of another secular move higher, is the commodity super-cycle back on? Those time frames shouldn’t matter much to us as swing traders, but I’m curious. Weird stuff is starting to happen.

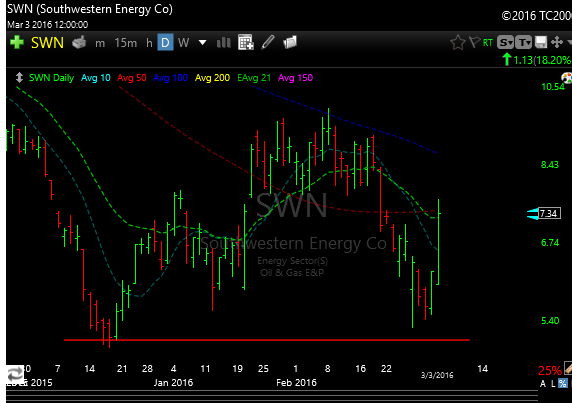

Just look at SWN today.

When energy stocks start trading like white hot biotechs, the FOMO (Fear Of Missing Out) gene can kick in. If this reversal is real then there will be ample time to make money here. Clearly the fundamentals don’t back it up, but since when does that matter? Its the stock market.

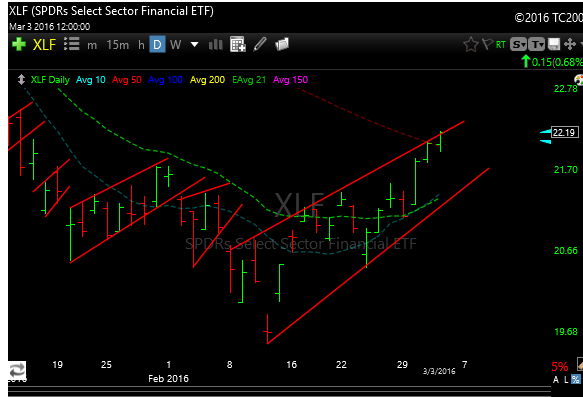

In other news, the financials (XLF) managed a slight close above its 50 day moving average.

All the FANG stocks were red today with the exception of NFLX which was up just slightly.

I could give 10 reasons for a bull move here and 10 reasons for a retest of the lows over the next few weeks.

Right now I really am really just processing and absorbing this all before my next move, while studying hundreds and hundreds of charts along the way.

The next big bull catalyst will probably be Draghi. He has basically telegraphed huge bazooka’s at the ready with that wink and nod at the ECB meeting last month. Not sure if he spent all of his capital last month with that though.

Things were looking a bit overbought at SPX 1960, but as you can see we’ve managed to inch up to the 1990 zone.

Tomorrow is the monthly jobs report.

- Economists expect February non-farm payrolls to gain 200,000 (190,000, depending on your survey). For reference, the average monthly gain last year was 228,000. In January, we added 151,000.

- The unemployment rate is expected to come in at 4.9%, in line with January. This was an 8-year low, and economists would like to see this number stay below 5%.

See you in the morning.

P.S. Some of you comment in the comments section of the blog, I rarely check that. Make sure all of your comments and market chat are sent to my email at [email protected]

I welcome your comments or questions.

Joe

Special….2 years for $599 this weekend.