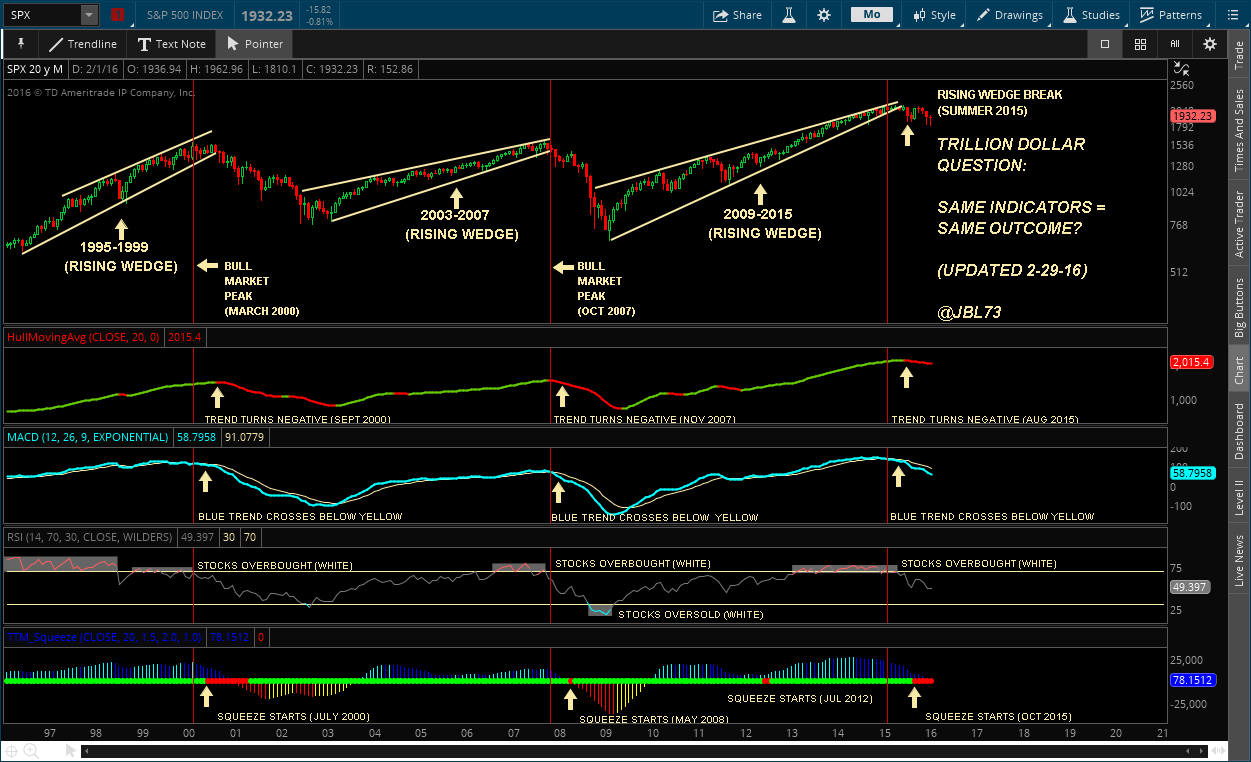

chart courtesy @jbl73

DJIA -123.88 at 16515.75, NAS Comp -32.52 at 4557.89, S&P 500 -15.85 at 1932.12 Volume: Trade heavy over 1.23-Billion/shrs exchanged on the NYSE

I love this chart. I look at it a lot because I constantly think about what “could happen”. You can see the time frames on the chart and its very interesting. It basically highlights the duration of past bull market uptrends and then what happens next.

Where we find ourselves now, is eerily similar to snapshots of time in the past. History doesn’t always repeat but it does often rhyme, so I like to look at these things. Its helps me stay grounded when I feel like going all in long when things just don’t feel right to me.

Right now, things don’t feel right to me.

This is day two of a failed rally. I went over Fridays failed rally on last night video, but it was not a confidence builder from a technical perspective. Today, we rallied and failed miserably yet again. What’s up with that?

The tape looks tired and there are no catalysts right now. We just grind around. We are basically rudderless at this juncture. Gold and utilities were the leaders in January and February and that’s never a bullish sign. There isn’t any leadership from tech or the FANG stocks. So its hard to be all bulled up here.

Am I calling a top or channeling Chicken Little? No, because the sky isn’t falling yet.

Right now we are down 30 SPX point from the top on Friday. I just have to wonder, absent a positive catalyst, if we don’t just roll over again. Technically, all the MACD’s ( moving average convergence divergence) on the index’s hourly charts crossed down today. I use MACD a lot, and its a great tool in spotting short term momentum changes.

One of my favorite overbought/oversold indicators, the McClellan Oscillator (mentioned in the video), came very close to an overbought reading on Friday, and it couldn’t go higher today. See below. This has been an incredibly accurate tool for us in the past.

The one thing that I think will create a short squeeze would be positive news on oil, then all short bets could be off for couple of weeks. Right now though, I’m not seeing anything other than an occasional rumor about a sit down by OPEC members.

WSJ Headline

Stories about China, negative rates, tightening dollar liquidity, tumbling U.S. profits, impending recession, oil and more have left investors with no clear narrative to follow

I couldn’t have said it better myself, because right now that’s what we have.

I took the stop on SCO today because it closed below the trigger.

I added TZA (short Russell) and long QID.

I know I’m like an overbearing mother that worries too much, but as Popeye says “I is what I is”

See you in the morning.

Joe