“Every time crude drops a dollar, an angel gets his wings….and ten more oil companies go bankrupt”—Me

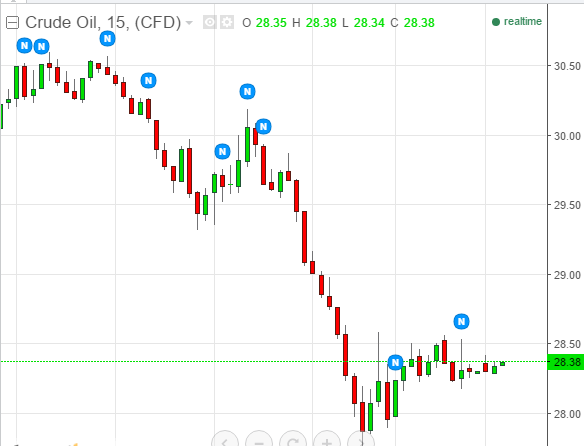

Crude got hammered today after the International Energy Agency (IEA) said the oil glut will get worse in 2016. As you can see below on the 15 minute chart it really got hit.

Iran will started dumping oil on the planet soon as well. They may have started this week in fact. Its quite possible that crude wants to go down and test that Jan.20 low around 26 and change.

Everybody is waiting on Yellen again, but I don’t know why. Fed funds are now saying there is a zero chance of rate increase. Usually a good indicator. Yellen cant raise, not when Rome is burning and the world is going negative rates.

Negative rates aren’t the answer but the globe is painted into a corner. If negative rates were swell, Japan wouldn’t have been down 6% yesterday.

Hedge funds, particularly US hedge funds, that once had plowed into Japanese equities including the banks, hoping that Abenomics would perform miracles, have abandoned the cause. Japan’s Government Pension Investment Fund, upon the urging of the Bank of Japan, sold its mainstay investment, Japanese Government Bonds, to the Bank of Japan and loaded up with equities instead. This process is now mostly finished, and it too stopped buying equities. Other pension funds did the same. So where will the demand come from when the “forced” buying has all but ended.

This will end in tears and I don’t just mean Japan, all the cool kids are doing it. (Yellen next?)

What Now?

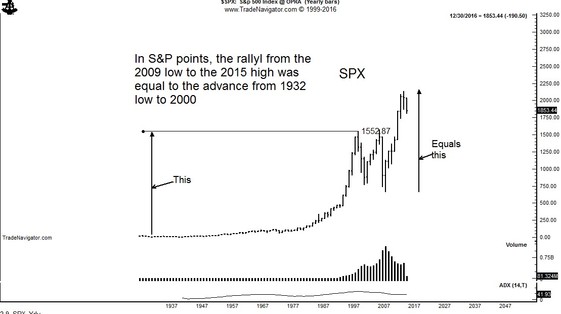

Markets don’t go straight down and they always have a tendency to overshoot on the downside and the upside. We could rally at any point, but think it will be short lived and I don’t see any bullish catalysts on the horizon….at all.

This market is tired and long on the tooth. The first thing that goes bad is momentum stocks and we’re seeing that in all its glory now. Its been a good run.

BUT DON’T FRET

Money gets made both ways in the market. 99% of traders and investors are one dimensional and take beatings in stocks that they should in fact be shorting. They don’t short. I think you have seen by now that I have no problem shorting things.

Don’t get me wrong, we will be long again this year, probably a lot because bear market rallies are the most spectacular. Just don’t trust them. The worm has turned to the downside. That’s my story and I’m sticking to it.

I took a little more UVXY off today +17.6% and covered the balance of the QLYS short +47%.

I ADJUSTED SOME STOPS TONIGHT, SO PLEASE CHECK THE P&L BELOW.

Click here for P&L

See you in the morning. Hope you are all holding up.

Joe