Deepening turmoil in China shook markets worldwide, sending oil prices plummeting to new lows and driving U.S. stocks to their worst-ever start to a year.

Thursday’s declines came after the People’s Bank of China depreciated the value of its currency by the most since August, causing shares in Shanghai to tumble 7% in 30 minutes before trading was halted for the day.

Stock markets from Asia to Europe to the Americas slumped in response, while the prices of many industrial metals and energy futures fell. U.S. stocks closed near their lows, with the Dow Jones Industrial Average down 2.3%.

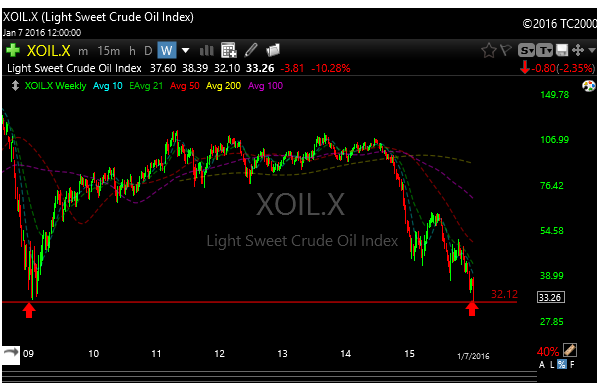

We’ve been talking about a retest of the 2009 lows in crude for a couple of weeks now. Today was special because not only did we retest the low we broke the low. Crude managed a slight bounce to close above it, but I’m not optimistic.

The market is in business to climb walls of worry, and we have seen much worse. We have only seen about four “global” recessions since 1960, the last being 2009, but if this keeps up, I think you will hear that “R” word more and more. I’m already hearing that we have started the bear market. I’m not buying into that just yet.

In the meantime, we are very short term oversold and could get a bounce as early as tomorrow.

I will be updating the P&L in the morning, as I was in meetings until very recently. You all should have received the email alerts though.

Hope you all had a great day.

Joe

PS …..If you are not receiving email alerts please let me know.