A sharp drop in energy shares clipped a three-day winning streak for U.S. stocks. The Dow declined 253 points, or 1.4%, to 17496 on today. The S&P fell 1.5%, pushing the index back into negative territory for the year. The Nasdaq slipped 1.4%.

Portfolio managers were likely selling companies in the beaten-down energy sector as they raced to limit investors’ losses ahead of the two holiday-shortened weeks left in 2015. As I said a couple of weeks ago, these guys had a few weeks to get these losses of their books as they approached year end.

It’s one thing to tell their investors ‘I was wrong,’ but it’s another thing to tell them ‘I got it wrong and I’m still carrying those names. We could still see a week or so of weakness in most beleaguered names.

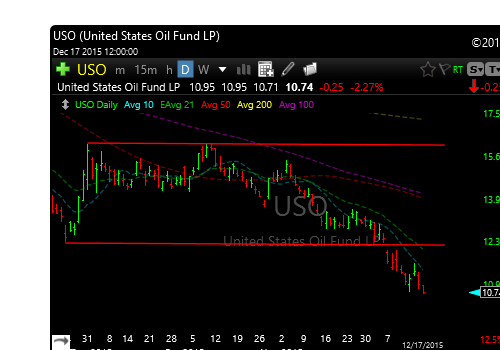

Energy stocks led the S&P 500 lower with a 2.5% decline, as crude slipped to its lowest levels since February 2009.

I wouldn’t put too much into today’s giveback, but if we follow through lower tomorrow I may have no choice but to visit the short side more aggressively.

I really feel the materials sector is going back down to test those lows. We have SMN to play this.

Tomorrow is one of the largest quadruple witching options expiration days in about five years. All kinds of derivatives of mass destruction are expiring, so tomorrow and possibly Monday, (day after expirations) could be volatile.

Santa came to play nicely with the reindeers until today, when he fell off the wagon.

See you in the morning.