European shares declined 3.1% as ECB policy changes were less forceful than expected. The Dow shed 252 points, or 1.4%, to 17478, losses that snowballed as the trading session entered its final hours.

The policy measures laid out by Drahgi were less aggressive than the markets expected. The market found the rate cut insufficient and had also been anticipating a pickup in the pace of bond buying.

Elsewhere, a rebound in the price of crude oil failed to lift energy stocks. The S&P’s energy sector (XLE) fell 2% after posting the biggest decline Wednesday.

Probably the most notable moves today were the big drops in the US Dollar and the big rally in the euro. The 10 year note and other treasuries had big moves too.

The Dollar

The Euro

10 Year Note Yield

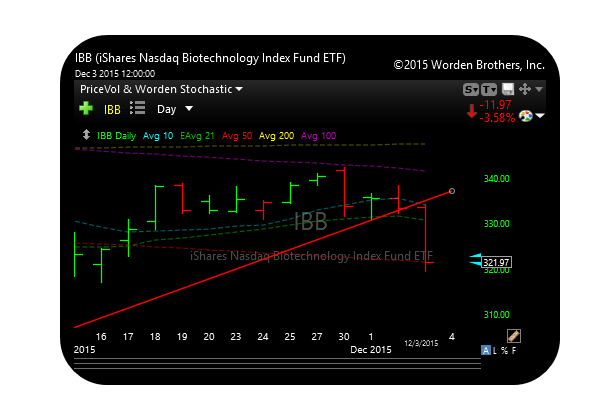

The other big story today was biotech. The IBB got face planted as it fell 12 0r 3.6%.

You have to wonder if market players aren’t just packing up their tents and getting ready for next year. All the major indexes with the exception of the Nasdaq are now negative for the year.

Tomorrow is the employment number for November, so we could see some movement either way. Don’t forget that we get another big dose of Yellen and the fed one more time.

P.S. When an idea gaps up or down through one of my stops or trigger prices I usually let that stock breath and I never sell or buy it at the open. Anyway BZQ gapped below my stop this morning. It drifted higher toward the end of the day. I am still holding and will advise going forward.

I also added SOXS as a long today. SOXS gets you short semiconductors.

See you in the morning.