U.S. stocks rose to session highs after notes from the U.S. Federal Reserve’s last policy meeting showed officials said it “could well be the time” to raise rates for the first time in almost a decade.

But look what the market did. It ripped higher. I now believe that if the fed doesn’t raise rates, the markets will most certainly tank. What a 180. The thing is, after years of wondering and fearing whether or not the fed will raise, the market has finally processed and accepted the fact. A failure to raise now could have an opposite effect and hurt stocks.

The Dow rose 248 points, or 1.4%, to 17737. The S&P rose 1.6% and the Nasdaq climbed 1.8%.

But you never know. Fed funds futures, showed Wednesday that they see a 68% likelihood of a rate increase from the Fed at its Dec. 15-16 policy meeting. The probability was 72% before the minutes. It had been 38% before the Fed’s interest-rate statement on Oct. 28. Also the 10 year note and the dollar were flt today, so there are still doubters about a rate increase.

Apple shares also helped to lift the market.. Apple popped 3.2% after Goldman Sachs issued a bullish note before the market opened.

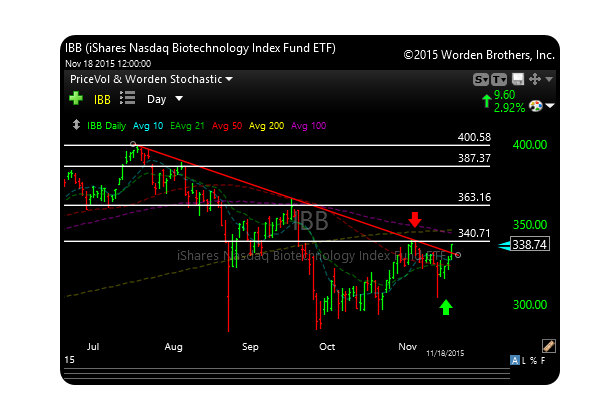

Biotech (IBB) rose almost 3% today and many stocks in the group look they are trying to break out of bases after the big selloff. If the market stays strong through year end, it would not surprise me to see a nice recovery rally in this sector. Hedge funds are under-invested and will chase anything to score some performance. Remember that biotech is “hot money”.

I added two new stocks today: RLYP at 20 and PACB at 8.25

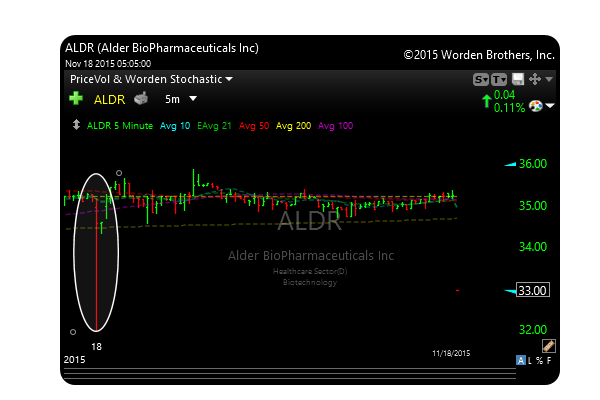

Just a note and something to remember. Never trade the opening bell. As I have said many times in this blog I don’t even like trading the first 30 minutes. Algorithms are on steroids and there are “bad prints” everywhere. To take it a step further, NEVER trade the pre-market. I mention this because ALDR had a huge spike down in the opening minutes and there was no news. This is not a stop and the trade stays active.

See you in the morning.