“Ours is not to reason why” —Tennyson

Let’s take a look at things shall we? Markets certainly look better especially with the fed seemingly at its back for now. That could change (or not) with the monthly jobs number later in the week. A hot number and the rate hawks will jump out of their skin, a cold number and “low rates for eternity” crowd goes crazy.

Are we overbought? The McClellan Oscillator says no and I find that to be very dependable as a guide. But, the MACD readings on QQQ, Dow 30 and SPX are at historic highs. So there’s that. Complacency is high (maybe for good reason?) because the VIX is showing a very low reading.

The QQQ (not COMPX) made new all time highs and the SPX is squeezing here, either for a massive breakout higher or a big fail. Fun stuff.

Biotech is acting better and XLE and OIH are both broke out today. Even drekish retail looks better.

Energy stocks got a big lift today because of diminished production in Brazil and a port blockage in Libya.

Gold is breaking down hard again. So is gold telegraphing a rate increase, or is it just rolling over because there isn’t any fear and gold just sucks as an assert class?

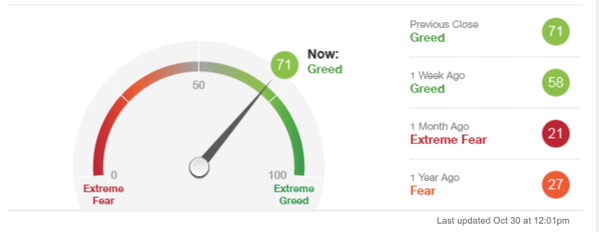

As of last week the greed index needle was fat and happy which can be a contrarian indicator.

I added AAPL as a long today.