Its so very difficult to time the market. Some make a living at it, but the road is paved with many wrong calls along the way. These folks have a tendency to be a stubborn lot, and refuse to change their opinions until they have been caught leaning the wrong way for a week or two or three. I’ve always been a tad better at calling bottoms than tops anyway.

Right now the market looks tired to me. Breadth seems ok, yet we languish and chop around. The fact that its earnings season makes it that much more difficult right now. A good report from a company can send the market higher and the opposite can be true on a bad report.

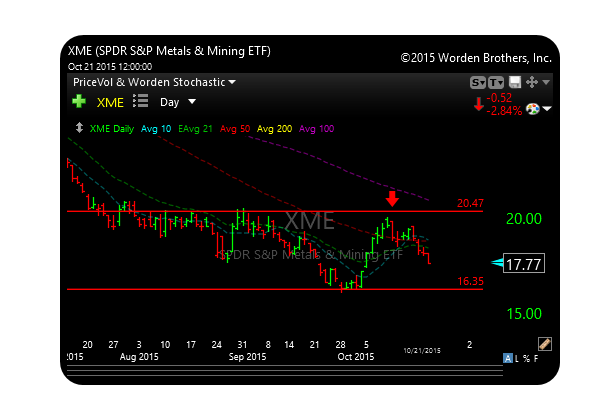

Many of the sectors that have rallied the last two or three weeks are still in serious downtrends and have basically just rallied back to resistance. Utilities (XLU) have rallied 10% over the last month, not necessarily a bullish sign, its just that folks are starving for yield.

Am I bearish? Yes, sort of. All the indexes along with many etf’s are backing off resistance and give the impression that they may be starting the beginning of a retest of the lows. Its still early and I may be very wrong, but it feels heavy to me. These are my observations and mine alone. I’m not calling for a panic selloff, but a retest of the lows wouldn’t surprise me one bit.

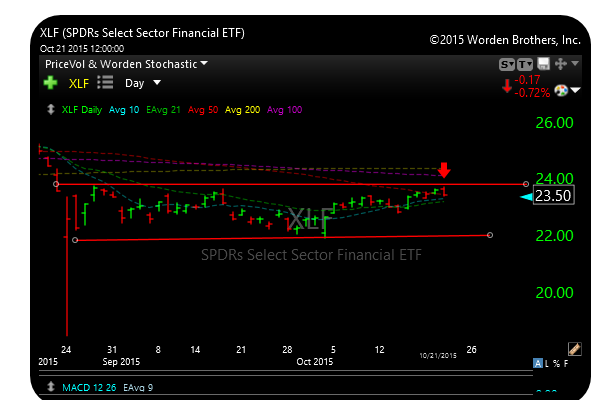

The market needs an upside catalyst here for a break higher. In the charts below you can see what I mean. I have posted the indexes as well as some key etf’s. Everything is poking at resistance, but cant seem to break out. Until such a massive breakout does occur, I will continue to remain cautious with a bent to the short side.

DOW-30

NASDAQ

RUSSELL 2000

XLF

XLB

XLE

METALS & MINING

I added UVXY back on the P&L today because there is no fear and complacency rules right now.

Let’s see how things shake out, I’ll see you in the morning.