Global stocks rallied Tuesday, buoyed by a late-session rebound in Chinese shares, but investors cautioned that more volatility could be in store for markets.

The Dow rose about 390 points, or 2.4%. The S&P advanced about 2.5% and the Nasdaq gained 2.7%.

China didn’t wet the bed overnight, so markets have started to adjust to worries over a slowdown in China’s economy. With the Shanghai off the front page for now, I think that the full focus will now revert back to the conversation about interest rates, and we all know how that goes.

The Fed heads at large have about two weeks to incessantly opine about rates and that always screws up the market. The market may have processed this possible event though and that would be a really good thing to help start a sustained move higher. Problem is, the market doesn’t ring a bell when that happens.

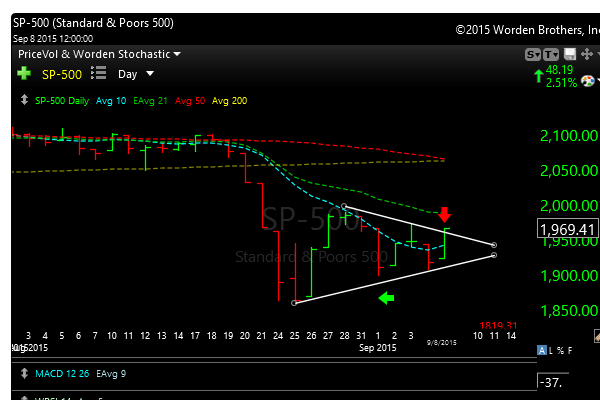

On a positive note, those bearish pennants that have been in pave for the major indexes looked a little better today, but nothing is more important than a solid follow through higher.

We’ve seen these big reversal rallies happen a lot in the recent past, only to see them fail miserably. Its not the first day of a reversal that’s most important, but the second and third day.

Remember that chart patterns have been decimated and need time to get their footing again. One day means nothing. The Dow fell 6.6% in August, so this market has to prove itself again.

I will say though that things do look a bit better. Many etf’s were up over 2.5% and some 3%, that’s very good action.

See you in the morning.