“Moderation is a fatal thing. Nothing succeeds like excess” -Oscar Wilde

The market can be dramatic. The market is know for being excessive to the upside and excessive to the downside. It usually overshoots both ways. When this happens its good to play it smart and that means playing it smaller.

Last week was a good week, but you have to ask yourself if it just wasn’t a big fat dead cat bounce. There is no way to know yet, only time will guide us. Its very easy to get overly excited and ginned up, but yiu pay me to help keep your feet on the ground.

This rally may indeed continue over the short term, but please remember that charts have been incinerated and need work, work usually means time. Time will tell us if this is just a false start or the real thing.

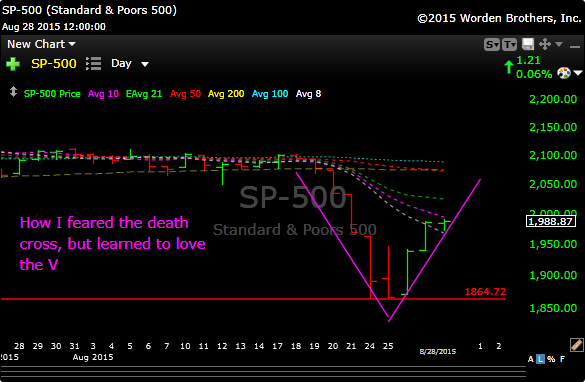

Remember that a week and half ago every news outlet led with the story of the “death cross” on the Dow. Now they all like to talk about the possibility of this great “V” recovery. Its all quite bipolar and things change so fast.

They are fun new buzz words, but they only come out of the woodwork when the market gets hairy. Let’s see how we start off the week. A rollover lower as we approach resistance would not surprise me. So let’s tread very carefully here.

See you in the morning.