Equity indices endured a shaky open after the overnight session featured more selling in European and U.S. bond markets; however, that pressure abated shortly before the opening bell with the 10-yr note marking its low at 8:00 ET. At that time, the yield marked a session high at 2.36% and began its daylong retreat that ended at 2.26%. The ensuing rally in Treasuries started a rebound in equities with the S&P returning above its 50-day moving average (2,089) after sliding beneath that level at the start.

The Russell 2000 is the only major index under its 50 day moving average.

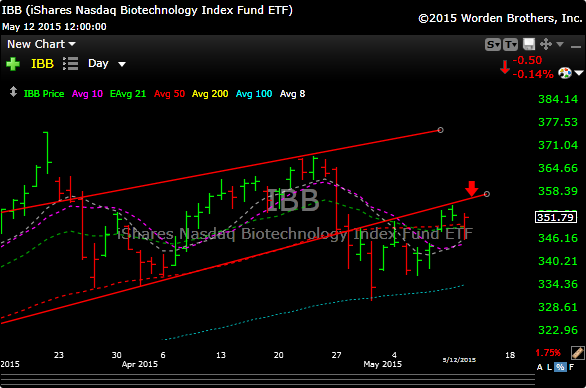

The biotech etf (IBB) once again regained its 50 day moving average, but boy has it been a struggle lately. It still remains under uptrend line (red line).

When they asked Willie Sutton why he robbed banks he said, “because that’s where the money is”. Right now, as choppy and as challenging as the markets are, some of the best setups (exception NLNK) are biotech.

Based on this, I am adding ESPR, we made a billion points on this a couple of months back and it looks like its setting up again.

Buy 109.60 area

See you in the morning.