The stock market began the week with a pullback from record levels, but not before setting fresh intraday record highs during the opening minutes of action. The S&P 500 (-0.4%) registered its first decline in four sessions while the Nasdaq (-0.6%) underperformed.

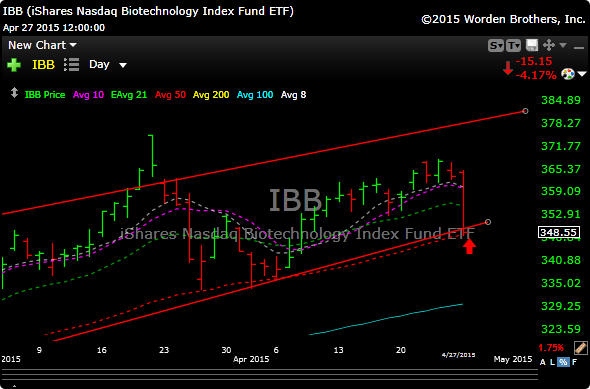

Biotech was the culprit today and added to the weakness in the Nasdaq. In the close up view of the IBB chart below, you can take a look at today’s action. Not good. As you can see it was down $15 0r 4%.

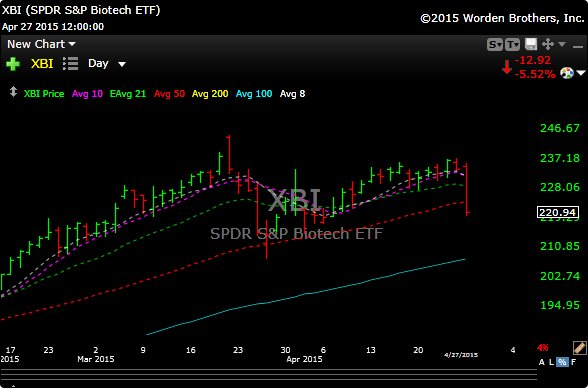

XBI, the SPDR Biotech etf, was down 5.5%. As you can see, this closed below its 50 day simple moving average.

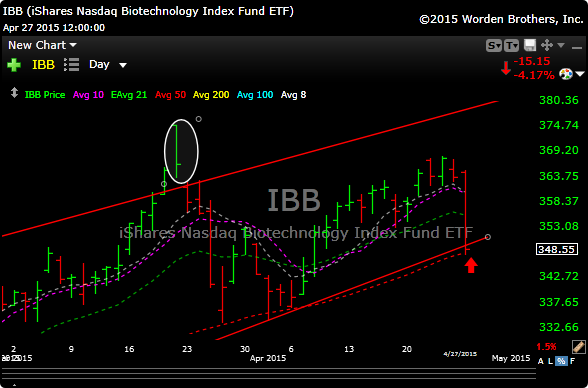

The move in biotech today was about as ugly as the move we saw just about a month ago. See white circle in the chart below.

Biotech is correcting right now, and this looks more to me than just a little blip, as the selling was pretty violent today. It will be important for that IBB uptrend line and 50 day ma to hold over the next couple of days.

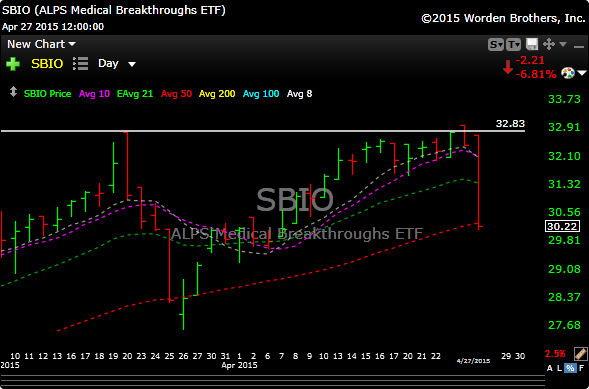

SBIO– (smaller cap biotech etf) got hammered for a loss of 6.8%. We sold some the other day and I raised the stop today.

Not sure if this a permanent trend change or just the beginning of a 5- 10% correction, but today I sold some, raised stops took some stops. I am speaking more to the biotech sector, not so much the general market.

We have huge data this week and a Fed rate decision on Wednesday, so my guess is that market could be indecisive and choppy as we plow through the week.

I do think though, that “bad news will be good” for the market as the Fed wont be in play about rate increases.

We were active today on our P&L. I sold some names and adjusted some stops, so if you are following along, please check it and stay current.

See you in the morning.