The stock market ended Wednesday on a higher note, but not before making a couple appearances in the red. The S&P 500 added a modest 0.3% while the Nasdaq Composite (+0.8%) outperformed.

Equity indices climbed out of the gate with the Nasdaq receiving major support from biotechnology. Meanwhile, the S&P 500 notched its session high during the initial 30 minutes, but returned to its flat line shortly thereafter amid significant weakness in the energy sector (-1.0%).

The energy space was pressured by a tailspin in crude oil futures after latest data from the American Petroleum Institute revealed that crude inventories increased by 10.9 million barrels since last week. As a result, total inventories have reached levels not seen at this time of the year in at least 80 years. WTI crude fell 6.5% to $50.44/bbl, erasing its Tuesday advance, and cutting into its gain from Monday.

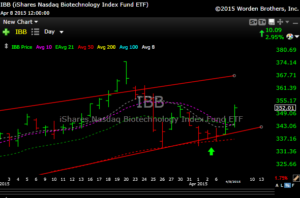

IBB outperformed from the get-go and extended its gain after Mylan (MYL) announced a proposal to acquire Perrigo (PRGO 195.00, +30.29) for $205/share. The news sent shares of PRGO higher by 18.4% while the biotech ETF advanced 3.0% and kept the Nasdaq in the lead.

Biotech is acting better, but still has work to do. Some biotech that had big days were JAZZ, ATRA, INSY, ANIP, CALA, JUNO, MYL, RGLS and SCMP. There were many 4-5% pops all over the place today. So its nice to see biotech playing nicely with the other kids again.

China exploded today (FXI)

See you in morning.