The last seven trading days have been the most bizarre we’ve seen in quite a long time. The last three days though, borders on the insane. The cause of all this appears to be Europe again. Mario Draghi shocked the markets today as he said more countries should help Europe, implying that Europe is feeble at best and printing money cant last forever. Germany, which has been a standout, has weakened of late and some say it borders on recession. Italy is also slipping fast.

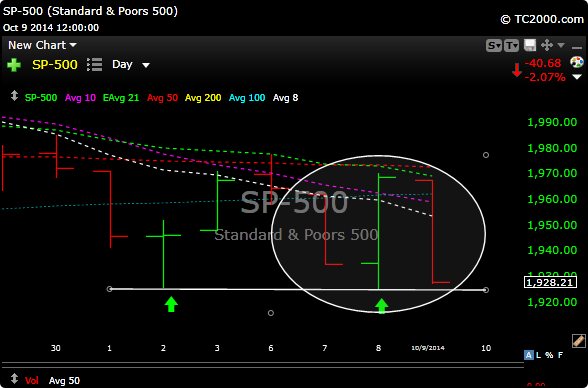

Although the SPX held the lows today (see chart below) it is on very shaky ground and if it were to break, we could quickly test the 200 day moving average around 1904.

If the market follows its recent pattern you would expect a rally tomorrow but who knows. I think the second tripe digit decline in three days may have the markets less enthusiastic about buying the dip right away, it may need a few days or a week to settle and carve out a bottom.

This one surprised me. I thought after yesterdays strong rebound we had definitely hit a bottom because it was a very impressive reversal. It wasn’t in the cards.

Meanwhile the Russell 2000 continues to slide and make more lows.

Lets see if the bulls have a Friday rally in them. See you in the morning. I’m glad its Friday.