The market stopped going down after the first five minutes of the day then rallied throughout the day and ended pretty much unchanged. For the day the SPX/DOW were -0.25%, and the NDX/NAZ were -0.15%. Bonds gained 13 ticks, Crude rallied 90 cents, Gold lost $1, and the USD was lower. Short term support is at 1973 and SPX 1964, with resistance at SPX 1986 and SPX 2000.

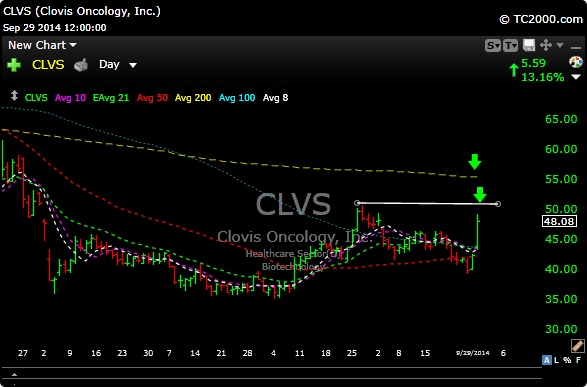

RCPT and RARE triggered today and I sold 1/2 TA. I also added CLVS as a new swing trade long.

Keep your eye on PANW and AKBA as they look ready to breakout too.

I added CLVS during trading hours today. Here;s why. It opened higher on some good lung cancer news. The stock broke above a downtrend line (red line). That’s significant because the volume was outstanding. The best daily volume since June and the MACD indicator is trying to turn up.

This could have the potential to be a strong continuation higher in the weeks ahead.

Stretching the chart a bit, you can see possible targets of 51 and 56.

See you in the morning.