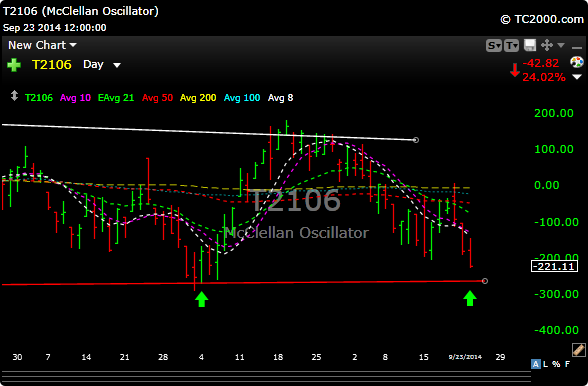

It was day three of the selling, the last two worst than the first. The McClellan Oscillator which is an indicator that telegraphs overbought and oversold conditions is getting “oversoldish” Back in early August, when we bottomed, the Oscillator showed an extreme overbought reading of about -287. Yesterday it closed on the lows of the day with a reading of -221.

Anyway, what all this means is that we may getting very close to a tradeable bottom. The 50 day moving average for the $SPX is just 5 handles away. If that doesn’t hold, uptrend support comes in around 1950, so keep that in mind. Calling bottoms is a fool’s errand, but its a decent indicator to pay attention to.

Meanwhile over in biotech land, Acordia $ACOR just bought a private company with an experimental drug for $500 million. Also, as ebola fears grow legs $TMKR keeps going higher everyday. Generally the $IBB has held in very well in this little sell off.

Oh, and I still think this will happen.

You can sign up here for my Free Swing Trading Tips.