I have a buddy that is a former block trader at a major firm. Now he’s an investment adviser in town, so I went over to say hi the other day. There were about five advisers there, all were older than dirt. One was actually napping. I felt like I should have brought something; like chest paddles or embalming fluid. Next time I’ll be more prepared.

I asked what these guys do. He said that have countless millions on their client money lines and about 90%-95% of the assets are in bonds, some preferred stocks. They really have no exposure to common stocks. Many of their clients aren’t older folks either; many are in their prime earning years. This is probably a microcosm of what is going on around the country. Chunks of this money will eventually go to stocks. It will have to.

The market made more highs last week on lighter volume, but the holidays are right around the corner. From my personal recollection, Thanksgiving week has always had a bullish bent. Lighter volume doesn’t mean you can’t see some really good action. Sometimes the action is actually better because of that fact.

Here are some setups to put on your radar for next week.

$KEY is flagging on the daily, watch for a move through the 13.05 zone with volume.

$MCD Mickey Dees may be attempting to break out of this down channel that started back in April. Watch for a move above the 99 level. Good volume will be important.

$GREK I talked about this one (Greek market) at lower prices, but it looks like its setting up again for another run at higher prices. You can buy it here with a stop just below the 50 day ma.

$TTHI I originally recommended this one around 4.10. A potential breakout pattern is developing at 5.30. Target 6-6.50

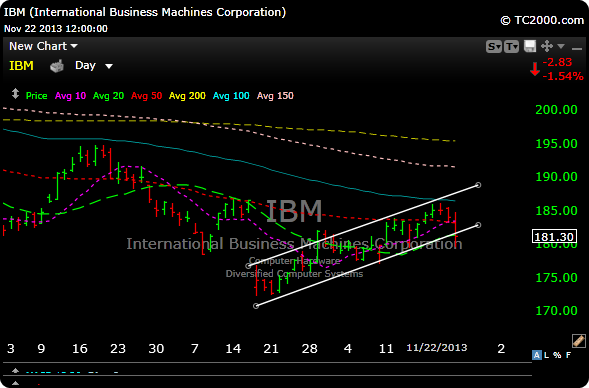

$IBM I put this out as short Thursday morning on Stocktwits. The stock is in an ugly bear wedge and is in the process of breaking lower. Friday’s volume was about 50% higher than its 50 day average.

Stop by for a