{+++} The bulls came back today after they realized taper talk is silly and stocks have to go up because the world is printing. Japan has had a bullish breakout last week and the yen is starting to fall out of bed again (DXJ). China (FXI) still looks strong after its breakout on Monday.

The Dow Jones hit a new closing high today, but the SPX didn’t. The Russell 2000 had almost a plus 2% day and the Nasdaq was up 1%.

The action was much better and the financials were strong+1.5% (XLF), which is always important. We are doing well in the FAS trade and I think the banks go much higher.

Some of our P&L names like CPHD, DXJ,ARTX, BIIB, AMBA, ZNGA, and VRTX have had decent moves the last couple of days.

Winners today included: GOOG +11, NFLX +9, GMCR +8.67, BWLD +8.20, BIIB +6.27, AAPL +6.20

Losers today included: ROSS : -7.50, LQDT-4,85, GME-3.74, TFM-6, VJET-5.50

It feels like the market wants higher into year end. Yesterday was a test of the bulls mettle and they came right back today, so that tells me they want to be long stocks. 1850 can still happen over the next five weeks. Who knows, maybe even higher.

Here is a new stock addition.

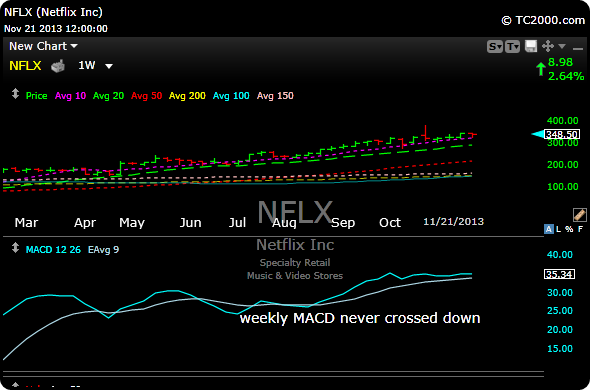

I’ve been watching NFLX since its earnings drama few weeks back and the action is starting to impress me as the MACD turned up this week. You know I love my MACD turning up. There is still a ton short in this name, so any good news, (I think there will much good news over the next six months), will only take it higher.

Here is a look at the daily NFLX chart. As you can see, the daily MACD turned up this week. This is one of my favorite signals (not perfect), but can be a “tell” for future price action. This worked like a charm and signaled the turn up in the Dow and S&P back in mid October if you remember.

As you can see below on the daily chart, the MACD has turned up.

As you can see below on the weekly chart, even though the stock had a price shock back on October 22, the weekly MACD never crossed down.

Watch for a breakout at the 350.50 area. My strong suggestion with a stock like NFLX, which can have vicious swings up and down, would be to buy a 1/3 to a 1/2 position at the breakout price, unless it is really breaking out with extreme volume, then you can take a full position. The reason I say this, is because many breakouts will fake you out and come right back in.

The entry and stop are is listed on the P&L.

Have a great night and I’ll see you in the morning.