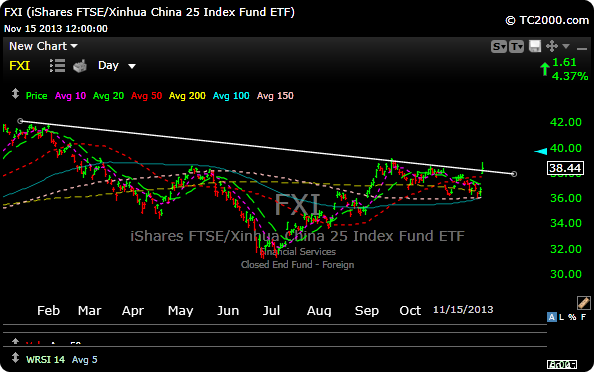

Last week China’s leaders disappointed the market with a vaguely worded statement on reforms. The markets were unimpressed and the Hong Kong’s Hang Seng Index and the Shanghai Composite proceeded to drop 1.9% and 1.8%. That was last week.

But Friday afternoon, details began leaking out, juicing the Hong Kong and Shanghai benchmarks to 1.7% gains each by the close. That evening — several days earlier than expected — the government let loose with a 60-point list of policy tasks. The market loved it.

This sparked a fresh rally Monday — by mid-afternoon, the Hang Seng Index was 2.5% higher, and the Shanghai Composite was sitting on a 1.8% advance. So China reform is in motion, it’s a ten year plan, but optically its a good thing for global markets right now.

There is strong chatter this morning that the Volker rule may now be delayed until 2015.

Timmy Geithner goes to Wall Street and takes a stab at private equity as the president of Warburg Pincus. Sure, everyone goes from a public servant hack to the the CEO’s office. Happens all the time. The last private equity deal he did was when he tried to sell his house. Companies love to buy power, access, and Rolodex’s, and they will pay anything.

Bitcoin continues its journey to a million.

Good luck out there today.

Subscribe here.