Stocks pretty much look like they are resting sideways so far. I’d hardly call a move from 1709 to 1691 for the $SPX a correction. It seems more rotational to me. Housing stocks continue to get hit hard, and we are seeing a move into materials sector $XLB. Stocks like $JOY $CLF and $WLT caught bids last week. Mostly short covering, but rallies in sectors or markets always start with a short squeeze, (see SPX 666). We’ll see if this is real soon enough.

Biotech ($IBB, $XBI) eased last week on some light profit taking and the bull trend in that sector is still in tact. Right now it is holding the 20 day moving average. $AMGN exploded as the $ONXX overhang was removed. Biotech stocks still have some of the best setups out there, but use stops if you are playing them as they can be widow makers.

The financials $XLF are on some minor support, but it may want to go down and test its 50 day moving average around 20.

Technology hangs in there, and names like $RAX that were left for dead, surprised to the upside and technically came all the way back up and filled the gap. $AAPL continues to act well, although it got rejected close its 200 day moving average on Tuesday.

$TSLA and $PCLN , two classic momentum names, didn’t fail to impress, as they both ripped last week.

Earnings season is pretty much over, so that will take the reporting risk out of the market.

Good luck next week. Here are some setups for you to put in your radar. Come by for a free trial here.

$CZR (weekly view) had a good week. Look for a continuation through 18.50

$CRM has earnings a coupe of weeks away. Watch the45.75 level for entry.

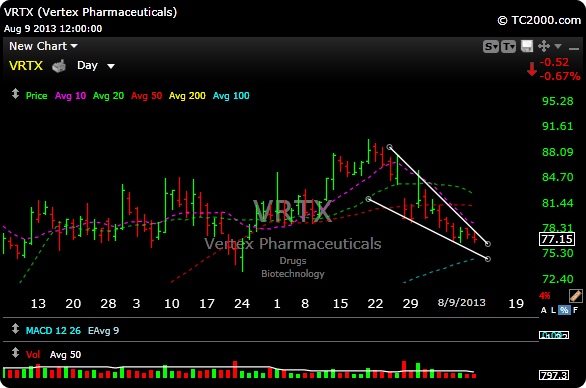

$VRTX had a very sloppy couple of weeks of trading, but is forming a falling wedge on the daily chart. You can own it around these levels anticipating an upward breakout, but have your stop around 74 with is the 100 day moving average.

$VLTC is forming a nice pattern after a breakout a week ago. A move through 6.50 should get it to 7.50 and higher.

Have a great weekend.