“There is only one side of the market and its not the bull side or the bear side, but the right side”– Jesse Livermore

Any remaining will of the short sellers was scattered like brain confetti last week as the $SPX tagged and closed above the 1700 level. Next short term move looks around 1717-1725. The yell of the shorts is like Fay Wray’s silent scream, or that dream you have when you’re totally petrified but no sound emerges when you scream.

Stocks like $TSLA are in a world of their own as they tag new highs. The company sells more tax credits than cars and BMW is coming hard with electric, but buyers don’t care. $LNKD has doubled and $FB finally kissed its IPO price. Stocks are in Pandora before the bad humans came. The market’s only bad human right now could be Bernanke and he’s all in at the pump the last I checked. There isn’t any inflation, and unless you count part time work as employment, then the 6.5% target rate is still a pipe dream. It would take two years to hit the target at this tepid clip and FIVE years to hit per-recession levels, so print away. The market has become co-dependent on data dependency. That’s cool while it lasts.

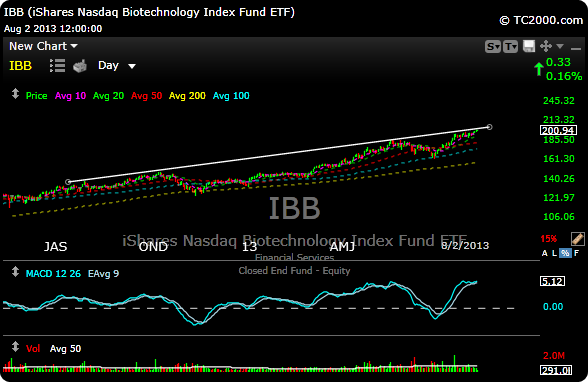

Biotech $IBB hit the top of a major bullish channel on Friday and will either rip the cover off the ball soon or take a little rest. My favorite group until it changes. The best set ups anywhere.

How about housing? $XHB was the best performing sector on Friday. Do you see a potential inverse head and shoulder on the chart? It’s also right at the short term downtrend line, watch out above if it gets through.

$XLF The financials look ready to go for more high and my fave is $C . Adorable how stocks go from dogs to darlings.

Sign up here for a free trial and to get the comprehensive Sunday video with setups and strategy. You can also request performance here.