{+++} The market started the week by making new uptrend highs Monday/Tuesday. Then pulled back into Friday morning before rallying to end the week about unchanged. For the week the SPX/DOW were mixed, the NDX/NAZ were +0.85%.

Short term support is at the 1680 and SPX 1658-1667, with resistance at the 1699 and SPX 1717 level.

I looked at a million charts this weekend, unfortunately the ones that I liked best are reporting over the next 2-3 days so I will avoid them until after they report. They were: YELP, WFM, CVC, LOPE, ACOR and some others.

For now I’m trying to find names that have already reported or are a month a way from a report. With that in mind, here are some solid charts that I will be looking to get long this week.

GE – is working on a picture perfect flag. Buy the 24.74 area. The stock can do 30 by year end.

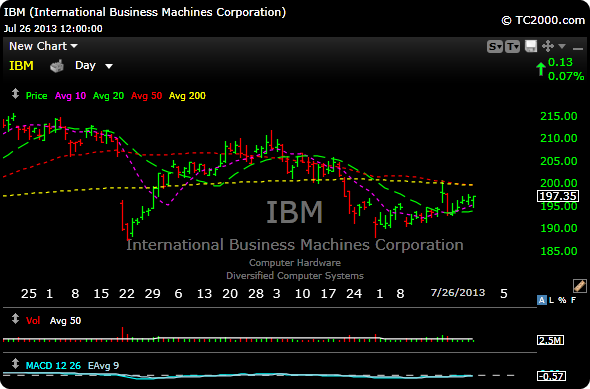

IBM– wont report gain until October but it is putting in a base (showing accumulation again) since its last disappointing earnings report. Its approaching moving average resistance by way of the 50 and 200 day. Buy the 198 level.

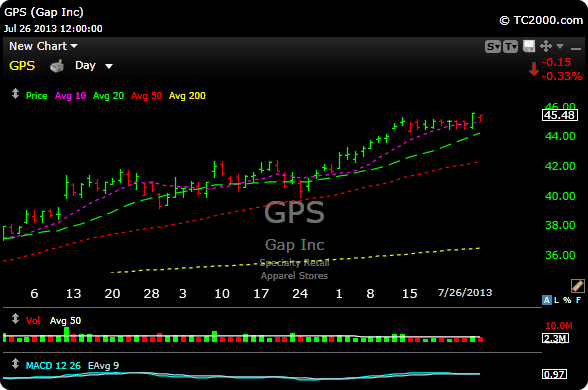

GPS– You can throw Gap Stores into the mix with NFLX and BBY as the most hated of stocks. Thing is, they all go up now. The chart looks ready for a breakout and they dont report until the end of August. Buy the 45.65 level.

CAT– This chart has been massacred, but I like the risk reward because I know exactly where my stop will be. This is the fifth test of support for CAT. It is also at the neckline of a massive head and shoulders.It’s either going to break or rally hard. I don’t now where this will open so by the 81-83 range.

See you guys in the morning