Today will be $AAPL‘s day and we will watch and opine. The company is looking at its first profit decline in a decade. Is it baked in? That depends on how bad the miss may be.

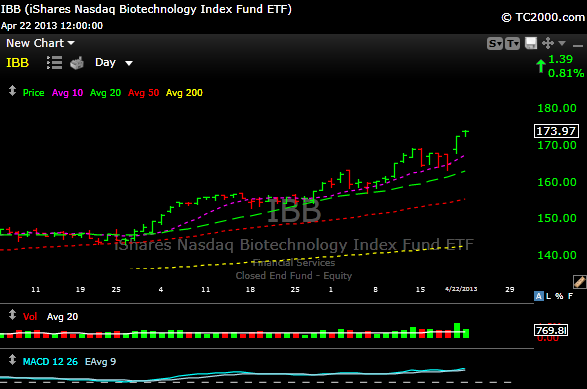

The biotech sector continued strong yesterday, as the $IBB followed through on Friday’s new high.

Yesterday $CAT came out with a bad miss and guided to the lower end of the range, but I still think thee stock may have put in a bottom yesterday. Take a look at the chart and see what you think.

The financials $XLF haven’t been doing much lately, but so far they are holding support around the 17.75 level.

What can I say, it’s a biotech world and we just live in it. Stocks like $GILD, $CELG $AMGN seem to routinely print new highs. Small names like $ASTX and $ACAD have been phenomenal performers. Watch $PCYC as it broke out of a downtrend yesterday and may have bottomed. We’re long.

$AAPL We’ll see if the world’s most overpaid operations guy, Tim Cook, can deliver anything today. Maybe give a hint of the future? I’m not optimistic. I’ve been obsessing about the need for $AAPL to tag that weekly 200 day moving average down around 372 (at least) to flush things out. It will be fascinating to see how the street reacts to the number after the close.

The big story was $NFLX yesterday. It ripped in the after hours and was up about 41 points. The stock looks like it wants a round trip to 300. I think it gets there on its own or with help from a buyer. My subscribers are long at 167. Good for them.

We’re having an amazing first quarter on my Premium Service. Come by for a trial. Have a great day.