{+++} Sideways is good. The market doesn’t necessarily have to get hammered lower to work off overbought conditions. So far the market is doing just that. It could last a while, but I doubt it as earnings and economic data will come at a furious pace.

From Jon Markman at Strategic Advantage:

Overbought. Bespoke Investment Group highlighted a recent spike in the S&P 500 10-day advance/decline line that pushed it back into overbought territory. It also pointed out earlier in the week that the percentage of S&P 500 stocks trading above their 50-day moving averages had pushed all the way up to 88%, a level not seen since October 2011. It noted that such extended breadth levels tend to be followed by sideways price action in the market at least until overbought conditions get worked off.

Sentiment. According to the AAII, bullish sentiment of individual investors rose to an 11-month high. In addition, Investors Intelligence noted that its current sentiment readings are near the danger levels seen at the two market tops in 2012.

I’ve been jawboning the last few days about this action only because I want everyone to be a little extra careful here. The market could indeed surprise us and take another leg up, but it also wont take much to knock 50 S&P points out of the tape either.

There are still some constructive patterns out there. Here are a couple of names that you should watch tomorrow.

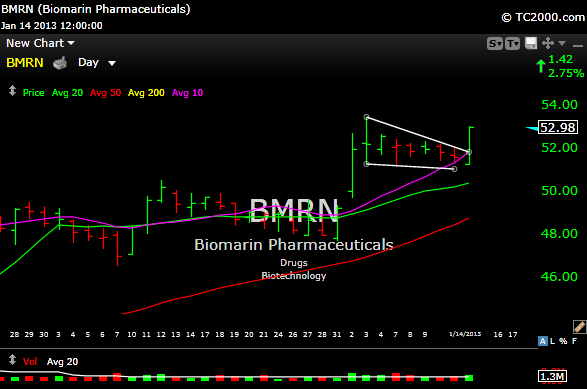

BMRN– I wish I caught this one this morning, but it still looks like it wants higher. As you can see, it is trying to break out of a picture perfect bull flag. It may be a continuation play with the buy at around 53.45.

KORS– I was watching this one today too, and wanted to see it close above the white downtrend line. It did so, and the volume was pretty good. I would get long at the Dec. 20 high at around 55.15. COH had a decent day today, so maybe some of the high end retailers are trying to make a comeback.