{+++} The market has dished out two very painful days to us. This sell off has been a textbook “sell the news” dynamic as the election results got sold. Would the result have been different on a Romney win? We’ll never know the answer to that one. Maybe the market just needed to let some air out.

As you can see in the chart below, the SPX (S&P cash) broke its 200 day moving average on the daily chart. That is a bearish event and could be telegraphing much lower prices. I’ve also seen these important levels breached temporarily and then it recovers for a strong counter trend rally. We will probably know tomorrow or Monday what will happen.

On the bright side, ( if you want to call it that) you can see in the chart below, that the SPX is getting very close to finding 50 day moving average support on its weekly chart. That level comes in around 1363. I think if 1363 gets tested successfully tomorrow it will be a signal to get long for a “trade”.

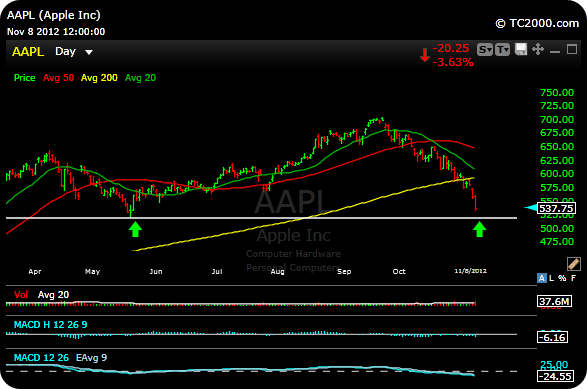

Let’s tale a look at AAPL. The stock has been a complete disaster. People are worrying about tighter margins, cannibalization, lack of future innovation and the biggest worry for technology..commoditization of the product itself.

As you can see above, the stock broke its 200 day moving average the other day and today it broke its weekly 50 day moving average. The stock is also falling on bigger volume. The green arrow back in May may be the next support for AAPL . That low was 522.18. I would probably want to put on longs in that area with a tight stop. I’ll let you know if we get there.

Technology has been in the wood chipper for quite a while now and AAPL is about 20% of the QQQ’s As you can see below, the 200 day moving average was violated a few days ago and is coming up on support around 61.50-62.00. We should see a massive rally in tech as soon as these things find a bottom.

I mentioned in last nights blog post that GOOG was ready to snap that ugly bear flag and test it 200 day moving average (yellow line). It broke it today and dropped about 15 bucks today. The 200 day moving average is 636 and may even get there tomorrow.

There is much to worry about right now. Fiscal cliff, jobs, a slowdown in corporate earnings, tax increases, the list goes on. The market as always, knows all, and is currently discounting all of this. That’s the way you need to look at it. The big question is where does it decide to stop.

Lets watch the 1360 level for some support. We are very oversold. I will have the P&L updated shortly. See you tomorrow.

Joe