Stocks fell to a loss as the dollar reversed an early loss to stage its third straight advance. After the close AONE, APP, LOPE, JOBS, MBI, RAH, TSLA, URS and ZAGG were the most notable names that reported.

Tomorrow morning before the open, four economic reports are scheduled to be released: 1) MBA Mortgage Applications (Consensus NA), 2) Initial Claims (Consensus 450K) and Continuing claims (Consensus 4350K), 3) Trade balance (Consensus -$44.8 bln) and 4) Export prices ex-ag. (Consensus NA) and Import prices ex-oil (Consensus NA).

Tomorrow before the open look for the following companies to report: CACH, CAE, CAGC, CVVT, CSC, DWSN, GBX, KELYA, M, MFB, NXG, RL, and XIN.

Brain Farting

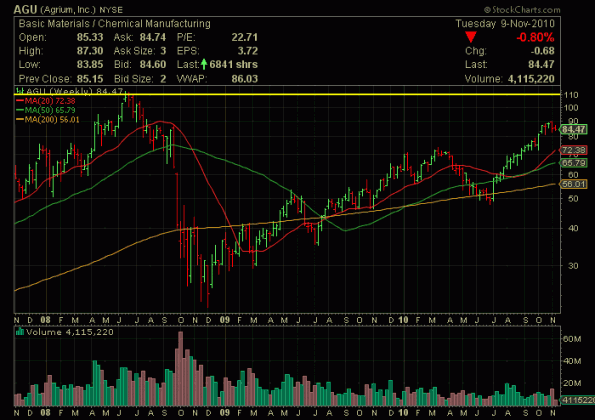

Just what if ???? What if these agriculture stocks have just begun their moves? I remembr trading them long a couple of years ago, and I vividly remember shorting POT at all time highs as the market crashed while analysts were caught wrong with Imodium AD pills in their vest pockets everyday. They were horrible then and they are even worse now.

I watched the dollar today, as I watch it everyday, and it got me to thinking. Bernanke is burning the dollar everyday, why can’t there be a massive blow off top rally to old highs on all commodities? It will take weeks if not a few months. I wish we had been long more oil a couple weeks ago, but I think oil is $100 by year end, and although I thought some of the fertilizer stocks were over bought (they are, and there will be corrections) but why can’t they hit all time highs? Bernanke is enabling this very trade. This is not a surprise or anything new, but what if?

I love this trade on any dips right now.

Premium content here