{+++}The broader market was dropped for a loss of more than 1% amid another bounce by the dollar, but some late session support helped stocks stage a strong swing higher into the close. After the close ALL; NSC; ORLY; QTM; SKX; TQNT and were the most notable names that reported.

Tomorrow morning before the open, one economic report is scheduled to be released: Initial Claims (Consensus 458K) and Continuing Claims (Consensus 4428K).

Tomorrow before the open of the many companies scheduled to report, some of the bigger names include: MMM, AVP, ABX, BX, BKC, CELG, CME, CCE, CL, DBD, DOW, EK, XOM, BEN, GT, IMAX, LLL, LVLT, MOT, OMX, OSK, POT, RTN, STRA, TEL, and ZMH.

Oil prices also were hurt by the rising dollar, which hit commodity prices across the board. December gold fell $16 to $1,322.60 an ounce while December copper tumbled 2.4%. That sent down materials and industrial stocks, the two worst-performing sectors of the day.

Housekeeping

In plain English the market has sucked. Choppy, tight trading range etc. These are the times to trade small, so when we get stopped it doesn’t hurt and you get to fight another day. Last earnings quarter I warned against trading at full throttle during earnings, I didn’t do it this quarter, but small is better for now. Is it so bad to take a half position? Earnings are almost over, but the election is next Tuesday, the consensus is that Republicans will take the House by a landslide, but not take the Senate. Who knows what will happen after that? The next couple of weeks will be interesting for sure.

Charts can go from sweet to sour quickly in this type of environment and the higher the market goes ,the more unforgiving the market can be.

For you newer subscribers or rookie traders a couple of things, there is no holy grail in trading and losses are part of the game. I hate when people say I’m hot, I detest the phrase. The market is littered with “bull market geniuses” that caught a little wave. I would much rater be “luke warm” all the time. Most of the clowns out there are very one dimensional in there trading, they are only long, only short and get destroyed more than 50% of the time. Most have never seen, or traded through a market cycle in its entirety. Most will never put themselves “out there” and prefer to talk about what just happened or what they would have done, not what they did do or are doing. They are called pundits or in some cases, just lousy financial bloggers.

The market is still all about the Fed and the Dollar, NOTHING else matters. More dollar destruction(reprieve today) and we will increase exposure to commodities of all types. I added UYM long & CREE short today as you know.

P.S. The Fed speaks Tuesday, which is also Election Day. Expect some fireworks between now and then. Regardless of party get out and vote.

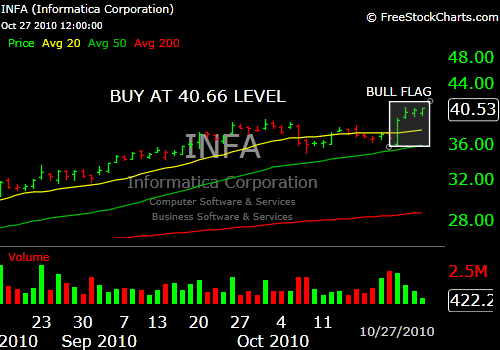

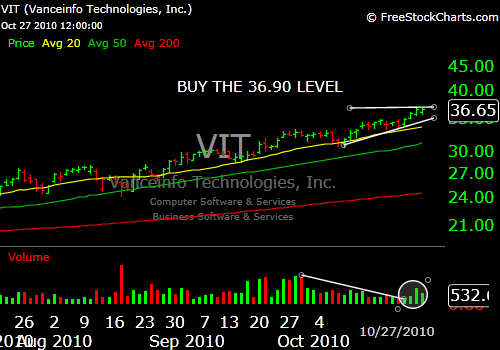

Some longs set ups still look great, here are a few. Please check the P&L every night for entry prices and stop levels.