{+++}Stocks set fresh four-month highs as buyers provided broad support amid a steep drop by the dollar, which was sunk by speculation of further quantitative easing. The stock market’s move to that mark was gradual. It had hesitated near key resistance levels, but got some additional support after the release of the September ISM Service Index. The Index came in at 53.2, up from the prior month and above the 51.8 that had been widely expected among economists.

The materials sector benefited the most from this session’s buying. It rallied 2.8% for its best single session advance in one month. Support for natural resource plays and basic materials stocks was augmented by a jump in commodities, which sent the CRB Commodity Index up 1.6%. Precious metals outshined as the continuous gold contract climbed close to 2% to set a new all-time high of $1340.60 per ounce and the continuous silver contract spiked more than 3% to a fresh 30-year high at $22.92 per ounce.

Here is a breakdown by sector: Materials (+2.8%), Industrials (+2.7%), Financials (+2.4%), Tech (+2.3%), Energy (+2.3%), Consumer Discretionary (+2.1%), Health Care (+1.8%), Telecom (+1.7%), Utilities (+1.1%), Consumer Staples (+1.1%)

Well, we closed above 1150 finally, and actually took out and closed above Thursday’s high of 1157 to close at 1160. Very bullish action indeed. The volume was also excellent for the first time in a while. Are we overbought? Yes. Are we over extended? Yes. Can we stay that way? Yes we can.

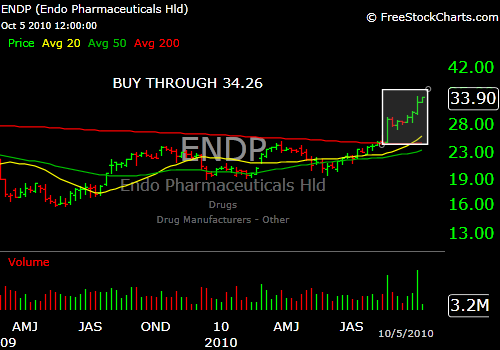

Please check the P&L for adjusted stops and entries. Two new longs for tonight.