{+++}

The new support for the SPX is clearly 1040. As you can see it is the level that has held now. It has tested and bounced around that level for six or seven trading days now.

We finally got the bounce that s many folks waited for, the question now is will we get follow through tomorrow as this market has proven time and time again that it is incapable of such a feat. My gut says yes we should have a decent open for a few reasons:

The shorts got creamed today and still need to cover some.

The financials (XLF) were off the chart powerful today, and registered about a 4% up day. Impressive to say the least.

We were way oversold and sentiment is still way bearish (contrarian)

Bottom line, it could be a confluence of short term bullish points for the bulls.

Notice that everything I just mentioned involves technicals and sentiment, there is NOTHING to be bullish about. I could care less that we had a semi bullish ISM number today, give me a break, Rome is still burning and the economy couldn’t be worse. That’s OK though, we just trade them. This all may change Friday with a bad unemployment number or it could be baked in, we’ll see, and I will try and stay as light on my toes as possible these next two days. You should too.

Housekeeping: The stops on the P&L are not necessarily ‘hard stops” (meaning to the EXACT penny) and for those of you that have been subscribing for a while know, I always give these stops some “wiggle room”. You may want to do the same. Obviously if the market is making a dramatic move one way or another, its very important to then use the stop. If you are a swing trader or someone who isn’t actively trading during trading hours, by all means use the stops as “hard stops”. I raise this point because of current market conditions, you can stop for a nickel or dime and then we get a reversal and miss a quick 3-4% move in stock. As you know, the market is not an exact science and requires a little finesse and eyeballing from time to time. Don’t misread me, stops are KEY to risk management and is as important as stock selection, but sometimes if you can’t bend you break.

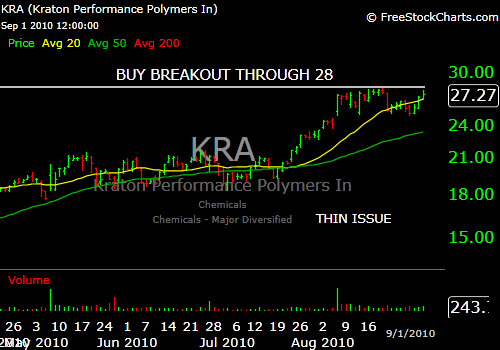

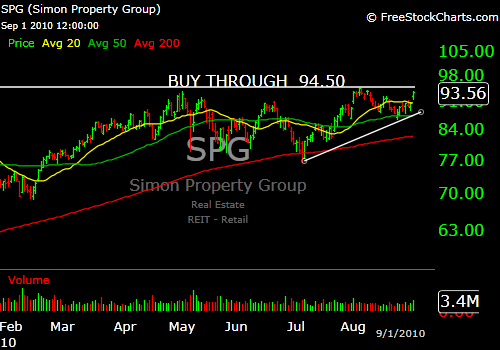

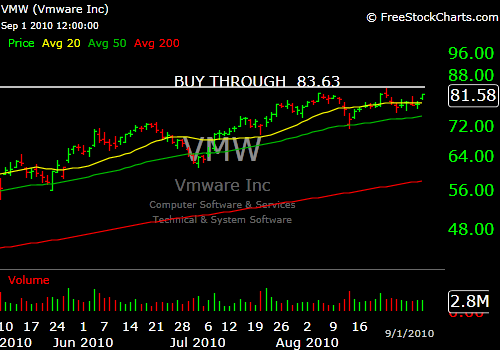

With that said, I am adding a few more longs tonight that may be setting up.