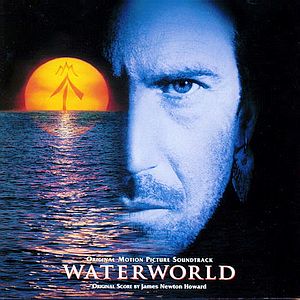

The drama in the Gulf continues, but Kevin Costner’s company has been signed on by BP to see if it can help the situation. Good for him, I hope it works.

The drama in the Gulf continues, but Kevin Costner’s company has been signed on by BP to see if it can help the situation. Good for him, I hope it works.

Consistent with Wall St analyst idiocy, about 80% of analyst ratings on BP are still at “buy”. How often have we seen this before? Anyway, just food for thought. The analyst herd is in the coral waiting for the first guy to blink. When the first one goes to sell, so will the rest. Will it matter at this point? The stock has priced in a lot, but maybe not everything. We’ll see.

We were hammered with existing home sales yesterday and today we get new home sales. The ban on drilling was overturned by a Louisiana judge yesterday and set off a quick rally in the drillers. It lasted about twenty minutes and most of them returned to and closed near their lows.

The bulls and bears have put down their long range missiles and have gone to hand to hand combat at the holy grail of support at 1100. Should be an interesting battle. The bears have some leverage here and the bulls need to dress up their quarter. Fun stuff.

The Fed also speaks today, gee, I wonder if they will keep rates at zero?

We are having another great week on the Premium Site. Some winners so far this week include: FAZ +.70, SMN +1.50, CNX (SHORT) +1.80, DRQ (SHORT) +1.00, HPQ (SHORT) +1.00, VCLK +.35, RL (SHORT) +2.00, LZB (SHORT) +.75

Stop on by and have a great day trading.