{+++}Today was a disaster for the market as the baby, the bath water and the piano player were all thrown out the window. Greece and Europe set the stage as serious contagion fears kicked in pre- open. Greece is still having problems and CDS spreads exploded in Spain, Portugal and other southern European countries. Remember, the market is fragile, and sellers always sell first and ask questions later. Thankfully we had some shorts, but in retrospect not short enough.

Our day was OK and I’ll take it, but I am never satisfied and will be very close to this market in the days ahead. The S&P closed just about on the 200dma and if that goes we could see a move down to 1150 pretty quick. This market though is so bipolar, that we could turn a around and rally tomorrow. Any further increase in the Dollar Index (DXY) and commodities and materials could really get hammered.

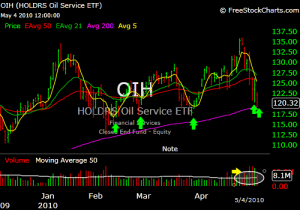

Commodities and materials especially got creamed. CLF, OIH, BUCY as well as many other gave back even more today. Because of the fear in Europe, the flight to safety kicked into overdrive and the risk trade quickly left the building. The financials were hammered, but oddly, GS was unchanged. Weird. Some of you took the BUCY short mentioned as a radar name on Sunday’s video, so congrats. AMZN closed on its 50dma last night and snapped it like a twig today.

We triggered on DE, SOHU, FUQI and QCOM today. Unfortunately IXPL triggered long, then whipsawed us after they reported a phenomenal quarter. We’ll revisit that one.

We took some profits on the long and short side today and now we play the waiting game. Will we have a vicious snapback or a follow through to the downside? Always a tough call and it isn’t a bad idea to be cautious, meaning REDUCE SIZE and KEEP STOPS TIGHTER THAN USUAL. It’s not time to be a hero. We will however press the hell out of this market long or short when the time is right, so stay ready.

As much as the oil service names have been pummeled, OIH continues to hold its 200DMA and RIG actually could have been worse today.

The financials (XLF) is on its 50DMA and a break with volume could send it to $15 and that would pretty much guarantee an S&P move to below 1150.

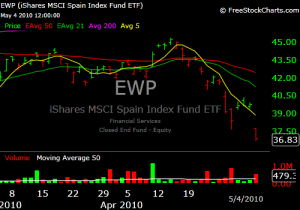

And my tombstone will read “He was right, but early on shorting Spain and got stopped out” I’m still losing sleep over that one.

You know I love my materials, but they are being beaten like baby seals. The (etf) UYM is the way I usually play the group long or short. The horizontal red line shows decent (not great) support around $33, but if that goes, it looks like the next stop is the $30 area. No position yet. We were stopped yesterday as you may remember for a buck.

We appear to have completed head-and-shoulder top formations on both the Nasdaq 100 and S&P 500. We could see some rallies, but it looks for now that the trend has changed and we may be heading lower.Many stock are at or heading rapidly for their respective 50 and 200 dma’s. Let’s let it breath tonight, maintain what we have and attack the situation tomorrow.

If there are any intra-day recommendations tomorrow,I will do it via the blog and chatroom.