As a new trading range develops in the S&P, 1050 to 1080-1100 many wonder what the next move will be. Will we take out resistance or will it drop lower under its own weight?

As usual, there are so many variables to consider, the health of Europe, the dollar, our own economic data and ever present geo -political risks.

All of these factors are connected in some way, which makes clarity on the issue very difficult.

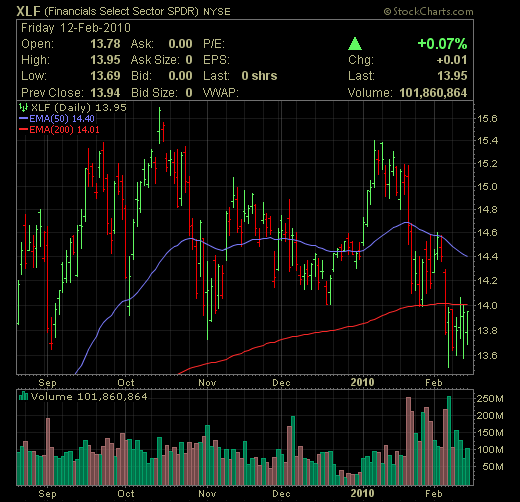

In my opinion, at this point in time, watching the action in the financial sector is key. The XLF has been trading under the 200 day moving average for about seven trading sessions and until the sector can rise above that level with some authority (volume) the market may just stay in a sideways, choppy pattern.

Some names that I watch closely, that look particularly weak on a technical basis are: MS, DB, BAC, JPM and UBS. If there was a gun to my head I like JPM from the long side, but I like it a bit lower for an entry.

New support for XLF is the low that was made on Friday Feb.5 at $13.51