{+++}Weak day for the bulls as the dollar decided to move higher today and closed above the 50 day moving average for the first time since April. That in itself could be significant, if it is, and the dollar continues higher, I have added some shorts to our sheets that look particularly vulnerable.

VISN acted very well today in a bad market and was highlighted again last night, NANO triggered long today and WFC triggered short.

Let’s see if this dollar move is for real, if it is the market will have problems going forward. The commodity sector has been a leader so if we lose that leadership role the market will be in trouble. The financials certainly look dead and look lower from here. Watch for a break of $14 on the XLF. I’m short WFC and today I added STI as a short. It reminds me of ZION when I shorted at $20 not too long ago, same issues as ZION, could be a sleeper. It’s not a formal rec., I’m just letting you know what I did. I will give it some time to work.

Be conscious of the dollar when shorting these names and I will see you tomorrow.

| Date | Symbol | Long Price | Short Price | Stop | Action | Result P/(L) | Triggered |

| 9-24-09 | |||||||

| MCO | 23.00 | 22.00 | Covered 1/3

Covered 1/3 Stopped 1/3 |

+2.00

+4.30 +1.00 |

yes | ||

| MHP | 26.19 | 26 | Covered ½,stopped on balance flat | +2.00 | yes | ||

| NAV | 40.31 | 39 | Covered 1/3

Covered 1/3 Covered 1/3 |

+1.30

+3.00 +2.03 |

yes | ||

| QSFT | 16.30 | 16 | Sold ½, sold balance(10-13-9) | +.80

+1.70 |

yes | ||

| SIGA | 8.43 | 7.65 | Stopped | -.80 | yes | ||

| MELA | 10.50 | 9.50 | Stopped | -1.00 | yes | ||

| 9-28-09 | COCO | 17.29 | 18.25 | Sold ½

Stopped 1/2 |

+1.00

-.90 |

yes | |

| ZION | 17.39 | 19.00 | Stopped ½ flat | yes | |||

| 9-30-09 | YGE | 11.90 | 12.60 | -.70 | yes | ||

| VNO | 63.00 | 65.50 | flat | +2.50 | yes | ||

| XCO | 19.05 | 18.00 | stopped | -1.05 | yes | ||

| MHGC | 5.60 | 5.20 | -.40 | yes | |||

| 10-1-09 | CALI | 6.35 | 5.50 | stopped | -.85 | no | |

| CENX | 8.97 | 9.60 | stopped | +.50 | yes | ||

| BAC | 16.02 | 16.80 | stopped | -.78 | yes | ||

| AAP | 37.70 | 39.40 | stopped | -1.70 | yes | ||

| 10-05-09 | EXC | 47.78 | 50 | stopped | -2..22 | yes | |

| JEF | 27.60 | 27.90 | Sold 100% (10-13-9) | +1.60 | yes | ||

| TSPT | 14.35 | 13.70 | stopped | -.65 | yes | ||

| HIG | 29.05 | 28.30 | stopped | -.75 | yes | ||

| APT | 6.25 | 6.00 | stopped | -.25 | yes | ||

| 10-7-9 | FCX | 73.43 | 73.00 | Sold half(10-13-9)

Sold balance10-14-9 |

+1.78

+3.10 |

yes | |

| 10-10-9 | PENN | 25.67 | 26.20 | stopped | -.53 | yes | |

| NITE | 23.00 | 22.40 | stopped | -.60 | yes | ||

| O | 22.85 | 24.00 | yes | ||||

| STEC | 25.51 | 25.80 | Covered 1/3

Covered 2/3 |

+1.00

+3.50 |

yes | ||

| ARST | 23.59 | 24.00 | Sold 1/3

Sold 1/3 |

+1.20

+2.20 |

yes | ||

| FIRE | 23.43 | 22.50 | stopped | -1.90 | yes | ||

| 10-14-9 | HRBN | 19.72 | 19.30 | stopped | -.50 | yes | |

| UCTT | 6.95 | 6.30 | stopped | -.65 | yes | ||

| 10-15-09 | MS | 33.35 | 33.00 | Sold all | +2.00 | ||

| 10-16-9 | QSII | 65.76 | 64.00 | stopped | -1.76 | yes | |

| ACI | 24.22 | 23.20 | stopped | -1.02 | yes | ||

| 10-19-9 | MEE | 33.64 | 34.50 | stopped | -1.20 | yes | |

| BTU | 42.35 | 42.50 | sold | +.20 | yes | ||

| FSLR | 146.80 | 152 | stopped | -5.00 | yes | ||

| ABAX | 23.86 | 25.00 | Covered ½

Covered 1/2 |

+1.00

+1.00 |

yes | ||

| PPD | 40.12 | 41.50 | Stopped | -1.30 | yes | ||

| MCO | 23.14 | 25.50 | yes | ||||

| 10-22-9 | MCRS | 27.40 | 28.00 | Covered 1/3 | +1.30 | yes | |

| AMAG | 35.10 | 35.90 | yes | ||||

| TNDM | 22.92 | 23.40 | Covered ½

Covered ¼ Stopped 1/4 |

+1.90

+2.30 -.48 |

yes | ||

| BAC | 16.05 | 16.60 | Covered 1/3

Covered 1/3 Covered 1/3 |

+.80

+1.00 +1.50 |

yes | ||

| VMI | 75.70 | 76.70 | Covered ½

Covered ¼ Covered balance |

+3.00

+3.00 +4.00 |

yes | ||

| CMG | 81.13 | 83.00 | Stopped | -1.87 | yes | ||

| ROVI | 28,09 | 29.00 | Stopped | -.91 | yes | ||

| CCL | 30.60 | 31.60 | Covered 1/3 | +1.30 | yes | ||

| 10-30-9 | RTH | 90.00 | 92.00 | Stopped | -2.00 | yes | |

| ROST | 43.76 | 44.83 | Stopped | -1.10 | yes | ||

| NIHD | 27.25 | 28.25 | Covered ½

Stopped 1/2 |

+1.90

-1.00 |

yes | ||

| FWLT | 28.12 | 29.00 | Stopped | -.88 | yes | ||

| 11-2-09 | CYOU | 29.00 | 29.80 | Stopped | .-80 | yes | |

| YGE | 11.17 | 11.70 | Stopped | -50 | yes | ||

| JLL | 46.38 | 47.20 | Sold ½

Stopped 1/2 |

+1.30

-82 |

yes | ||

| XHB | 13.70 | 14.30 | Stopped | -.60 | yes | ||

| WFC | 27.40 | 28.20 | Stopped | -80 | yes | ||

| 11-5-09 | FUQI | 19.14 | 21.00 | Stopped | -1.86 | yes | |

| CMG | 87.50 | 89.50 | Stopped | -2.00 | yes | ||

| EXPE | 23.60 | 24.70 | Stopped | -1.10 | yes | ||

| AIG | 32.66 | 31.00 | Sold 1/3

Stopped 2/3 |

+4.00

+1.66 |

yes | ||

| MEE | 33.68 | 32.00 | Sold | +3.60 | yes | ||

| BEC | 65.50 | 68.50 | yes | ||||

| 11-13-09 | GT | 14.56 | 15.50 | yes | |||

| 11-18-09 | FCX | 85.20 | 81.75 | Stopped | -3.30 | yes | |

| AGU | 55.80 | 55.50 | Stopped | -1.80 | yes | ||

| 11-19-09 | TSTC | 13.80 | 15.00 | Sold 2/3 on 12.2.9 | +2.50 | yes | |

| 11-20-09 | ABAX | 22.30 | 24.75 | yes | |||

| 11-23-09 | POT | 115.53 | 111.50 | stopped | -4.00 | yes | |

| MOS | 55.40 | 55.00 | Sold 12/2.9 | +4.90 | yes | ||

| 12/3/09 | VISN | 10.46 | 10.00 | yes | |||

| 12/6/09 | WFC | 26.00 | 29.00 | yes | |||

| 12/8/09 | NANO | 13.40 | 12.00 | yes | |||

| 12/9/09 | XTO | 40.20 | 43.50 | no | |||

| APA | 91.90 | 96.00 | no | ||||

| UPL | 44.92 | 48.00 | no | ||||

| EOG | 84.95 | 89.00 | no | ||||

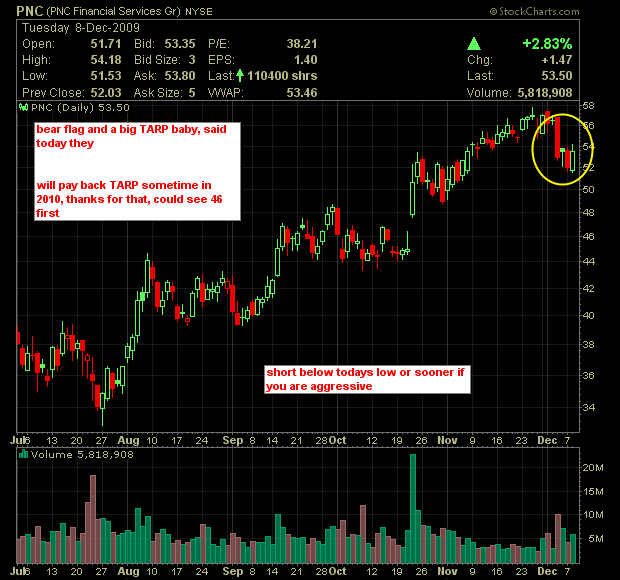

| PNC | 52.00 | 55.00 | no |