Trading began on a positive note this week, as indices pushed out to a fresh 13-month highs despite the slide in the November Empire Manufacturing data on Monday. Equity indices were flat mid week as October housing starts declined to their lowest level since April, and building permits came in to the downside

The week commenced with markets squarely focused on the first official remarks from Fed Chairman Bernanke since the FOMC meeting two weeks ago. The advanced text of his speech to the NY economics club appeared heavy on strong US dollar rhetoric, providing some hope for the weary greenback. This rhetoric was quickly dismissed as it became clear that a continued low inflation outlook coupled with a dismal employment picture will force the Fed to keep rates low for an extended period of time.

As PIMCO’s Bill Gross wrote in his monthly outlook this week, the US needs another 12 months of 4-5% nominal GDP growth before the Fed dares exiting the “0% foxhole, mini-bubbles or not.” He also said with money market funds yielding close to 0%, and some short-term U.S. Treasurys carrying no yield at all, buying shares of dividend favorites like utilities and pharmaceutical manufacturers has become more attractive.

Earnings, home-sales data, and a fresh estimate of U.S. gross domestic product growth all hit the calendar next week. Plus, the Federal Reserve will release minutes from its last rate meeting.

Financial names helped push overall equity markets lower last week, especially after another serving of doom and gloom from Meredith Whitney. On Monday she said “I have not been this bearish on financials in a year” and reiterated that banks will need to raise more capital. The press speculated that the administration would extend TARP through 2010 (last week it was reported that TARP has $239B in unspent funding).

Commodities, not surprisingly, benefited from the strengthening belief that rates won’t change any time soon. Gold prices continue to garner the lion’s share of headlines: the metal hit all time highs above $1,150 late in the week and closed not far below this level. Despite the run up, hedge fund guru John Paulson announced plans to launch a new gold fund on January 1st, backed by his own money. Following in gold’s wake, silver and copper are trading near their best levels of 2009.

Treasury prices surged on Monday helped by the fallout from Bernanke’s comments. The 10-year yield has spent the duration of the week under its 200 day EMA for the first time since early October. The move at the short end of the curve has been even more dramatic. Some T-bill rates went “negative” on Thursday while the 6-month bill hit its lowest rate on record.

Light trading volumes during the week could exacerbate any disappointments in this busy line-up of reports, all clustered ahead of the Thursday Thanksgiving holiday. Friday is free of indicators, though traders may react to anecdotes from the first wave of holiday spending as it is Black Friday for retail.

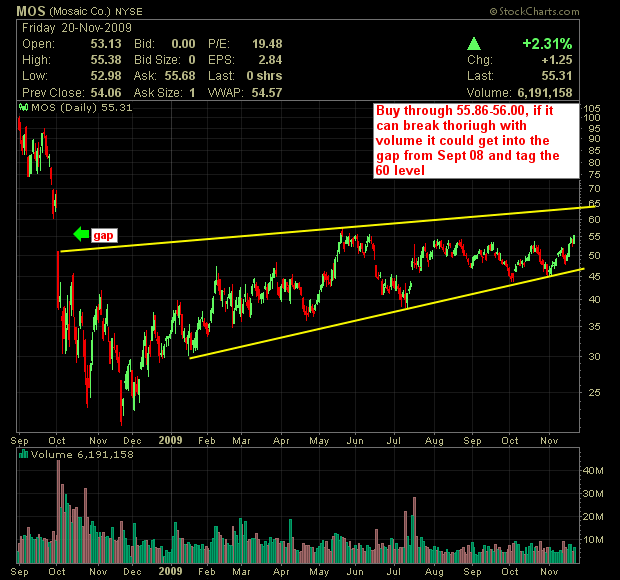

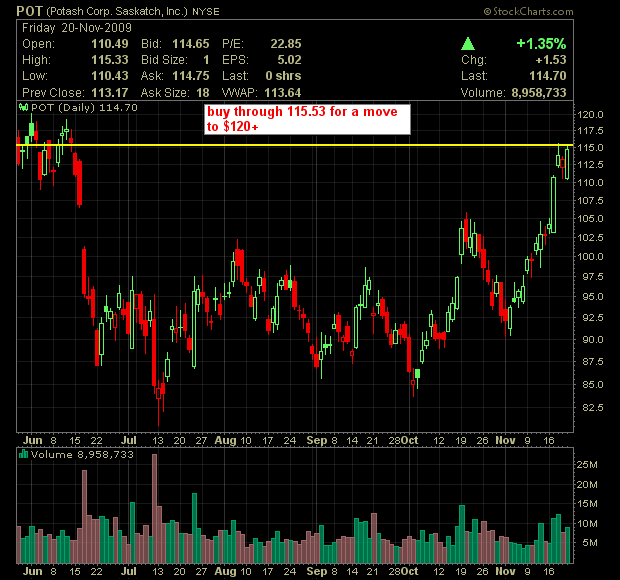

So what about the week ahead? A quick review of existing trades shows paper profits for MCO, AGU, BEC and GT with FCX hanging in very strong. I moved the trigger down on ACI as I like the way it held support at the 50 day moving average and I am looking for a possible bounce. I’m adding MOS, POT as longs and have re-added BBT as a short to watch.

I want to keep it there for now because of the holiday shortened weekend. Volume may be light this week, but it may actually present some good set ups.