{+++}

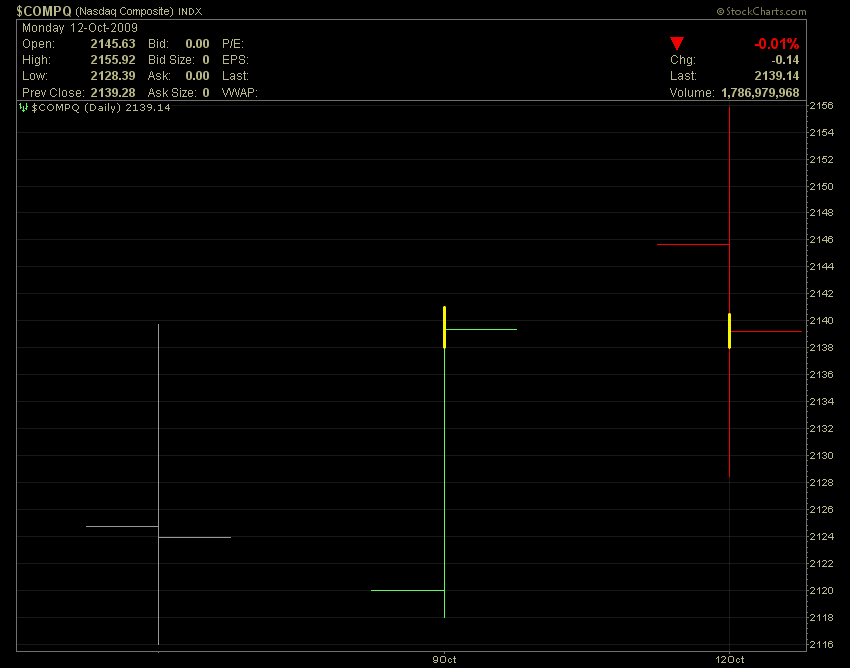

This a chart of the Nazzy close on Friday and today. I tweeted that it was an outside reversal day earlier, it actually missed by a few pennies, maybe significant maybe not.

An outside reversal day is when you see an intra-day breakout to new YTD highs, followed by and intra-day reversal (SELLOFF) and a market closing price that is lower than the prior YTD closing high.

We were right there near the close, and then the Nazzy rallied a bit to miss by pennies.

Why is this significant?

After we saw the Outside Reversal in the S&P a few weeks back, the S&P corrected by over 4% in the days that followed. The Nasdaq is up 37% YTD so it is something to watch. The fact that it closed a few pennies higher than Fridays close may or may not negate the reading.

Regardless, it’s something to watch, as you know I have been buying some NDX puts the last few days.