Well, the S&P closed technically where it should have on Friday to give the bulls a happy weekend, the volume was listless, but it’s been that way through most of the rally. You can go broke fast trying to argue the “why” of this market.

Big bank earnings are coming soon, let’s see if borrowing at zero has helped their bottom line. Have a great weekend.

The rich take Ambien too.

Your dollars are just monopoly money.

Interview with a mad hedge fund trader.

Blow up Citi, get a shot at running Bank of America

What ever happened to the “good war”?

Deficit hits $1.4 trillion, good thing we created all those jobs to pick up the slack.

Ron Paul wants more answers, good for him, I know I have questions.

Gasparino says at 10% unemployment, the banking crisis will get new life. True

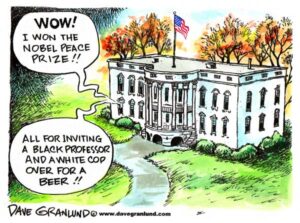

The Nobel mockery.

Blowing up the moon.

Roubini on how the Fed can avoid the next crisis.

Will M & A be the next bubble?

The great ATM robbery

What happened to cleaning up corruption?

Forbes on Capitalism

Baby Boomers will be moving their $10 trillion.

The Sunset Tower makes a cool comeback.

Is Macau and Las Vegas Sands two bubbles ready to burst?

Excerpt from unpublished Vonnegut

Posner’s “Miami Babylon” and its cocaine culture

Can CROX be more than a one hit wonder? The chart looks decent.

From David Rosenberg:

October 9, 2009

A “V”-SHAPED RECOVERY

In this particular case, “V” stands for Valuation because every basis point of this 60% rally in the U.S. equity market from the lows has been due to an unprecedented expansion in P/E ratios. In fact, by some measures, the S&P 500 is already trading at valuation levels that would ordinarily be consistent with an economic expansion that is five-years old as opposed to a recovery that, at best, is in its infancy stages.

ONE OVERVALUED MARKET

There has been plenty of debate over whether equities are overvalued or not, and certainly we would assume that many investors know where we stand on the topic. Let’s look at the facts now that the September data are in.

On an operating (“scrubbed”) basis, the trailing P/E multiple on the S&P 500 has expanded a massive 10 points from the March lows, to stand at 27.6x. Historically, when the economy is taking the turn away from contraction towards expansion, which indeed was the case in Q3, the trailing P/E multiple is 15x or half what it is today (and that 15x is also calculated off depressed earnings level of prior recessions – we have more on the historical comparisons below). While we will not belabour the point, when all the write-downs are included, the trailing P/E on “reported” earnings just widened to its highest levels in recorded history of nearly 140x, which is three times the levels prevailing during the height of the tech bubble.

It is interesting to hear market bulls talk about how distorted it is to be using trailing multiples that include ‘recession earnings’ (even though using ‘forward’ earnings means relying on consensus forecasts on the future and these are rarely, if ever, correct). It is also interesting that the last time the multiple was this high was back in March 2002, again after a huge countertrend rally that deployed ‘recession earnings’ from the 2001 downturn. If memory serves us correctly, this was right around the time that the bear market rally started to roll over and in fact, six months later, the S&P 500 was hitting new lows and 34% lower than it was when the multiple had expanded to … today’s level!