{+++}Charts courtesy of Calculated Risk

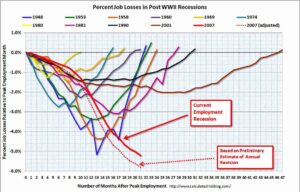

Ben Bernanke said last week that the recession was over, I honestly don’t know what he is looking at as a benchmark. Sure some economic indicators have bounced, but so will a cat if you drop it off the Empire State Building.

Ben Bernanke said last week that the recession was over, I honestly don’t know what he is looking at as a benchmark. Sure some economic indicators have bounced, but so will a cat if you drop it off the Empire State Building.

In my opinion the dynamic has changed for now, and with the short term trend on housing, financials and semis (XHB, XLF,SMH) breaking lower on good volume, I now believe the conversation will soon shift to the inevitability of a double dip recession.

Many stocks and sectors have broken their 50 day moving averages, or are on their way to breaking their respective moving averages. It really is all about that 50 day right now, some have actually broken their 200 day MA’s like POT. MOS is right on it and AGU looks like it may be on its way to the 200.

So much garbage has floated to the top during this bear market rally (AIG, and so may others), yes, it’s still a cyclical bull rally within a secular bear market, that’s my story and i am sticking to it. We were a breath away from a depression,so it will take longer than six months to repair the damage that took 10 years to cultivate, I’m talking years. There will however be, as you know,phenomenal trading rallies along the way. Folks like us will excel, the buy and holders will be obliterated as usual.

The S&P will be the topic of conversation this week, just as it was so many weeks before it broke out. This time the debate will be about its ability, or lack thereof, of holding its 50 day moving average, if it breaks, there will be trouble ahead over the short term.

The S&P will be the topic of conversation this week, just as it was so many weeks before it broke out. This time the debate will be about its ability, or lack thereof, of holding its 50 day moving average, if it breaks, there will be trouble ahead over the short term.

I personally will trade it as always, but won’t get real bullish again until we “close” over the 1050 level for starters.

Some short patterns as I said are now starting to develop and some will start to “flag” bearishly, they may just need another day or two. The market of course will have to trade flat or slightly up or down over the next few days for that to happen. Those bearish patterns could and will probably negate themselves if the market decides to roar higher.

The 980 level on the S&P is now support and could easily be hit or breached early this week, we also could just digest and trade sideways for a while, just be aware.

I have added 2 longs and 3 shorts for the week ahead. Sorry, co charts as I had a problem with Stockcharts.com, I will try and get them ouyt in the morning, Longs: JEF, TSPT Shorts: AGCO, CSX, EXC

| Date | Symbol | Buy Price | Short Price | Stop | Action | Result P/(L) | Triggered |

| 9-24-09 | |||||||

| MCO | 23.00 | 23.50 | Sold 1/3 sold 1/3 | +2.00

+4.30 |

yes | ||

| MHP | 26.19 | 26 | Sold 1/2 | +2.00 | yes | ||

| NAV | 40.31 | 40 | Sold 1/3, Sold 1/3 | +1.30

+3.00 |

yes | ||

| QSFT | 16.30 | 16 | Sold 1/2 | +.80 | yes | ||

| SIGA | 8.43 | 7.65 | yes | ||||

| MELA | 10.50 | 9.50 | -1.00 | yes | |||

| 9-28-09 | COCO | 17.29 | 18.25 | no | |||

| ZION | 17.39 | 19.00 | yes | ||||

| 9-29-09 | AZO | 142.00 | 146.00 | no | |||

| 9-30-09 | YGE | 11.90 | 12.60 | yes | |||

| VNO | 63.00 | 65.00 | yes | ||||

| XCO | 19.05 | 18.00 | -1.05 | yes | |||

| MHGC | 5.60 | 5.20 | -.40 | yes | |||

| 10-1-09 | CALI | 6.35 | 5.50 | no | |||

| CENX | 8.97 | 9.60 | yes | ||||

| 10-2-09 | X | 41.10 | 43 | yes | |||

| BAC | 16.02 | 16.80 | yes | ||||

| AAP | 37.70 | 39 | yes | ||||

| 10-05-09 | EXC | 47.78 | 50 | no | |||

| CSX | 41.25 | 43.00 | |||||

| JEF | 27.60 | 26.25 | |||||

| TSPT | 14.35 | 13.00 | |||||

| AGCO | 25.77 | ||||||