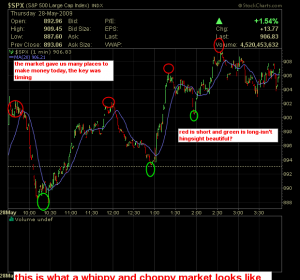

{+++}It was a whippy and choppy Thursday indeed, I ended a bit in the red today and I literally am exhausted and feel like I walked through a wind tunnel and then strait into a propeller. It was day for the fast money, primarily hedge funds, you can tell by the action, fits and starts and profit taking at every turn. Real buy programs look like a solid, measured stair case up, that’s when you know they are really coming for stocks.

Today is yet ANOTHER example of why it is so important to AVOID the first 15-30 minutes of trading. If you look at CLF (last nights pick). The trigger was 26, it opened at 25.80 ran through the trigger up to maybe 26.30 and took a ski lift down to 25.10-20. Had you waited until 9:45-10am you would have had a chance to pick it off AFTER the morning rush hour had time to settle. We are all guilty, me too, but please benefit from years of me getting my face thrashed off in the first 20-30 minutes of trading. If this is the one and the only thing you take away from this blog I will have saved you a fortune. Hopefully you will learn much more as we go forward.

Trading is hard enough, but if we can eliminate some basic 101 type mistakes it will make the rest that much easier.

I am still short KRE around 19.30 from this morning, as you know I alerted you of the trigger for a short at $19. I’m usually flat at the end of the day but I will give this one a little room, but just to be safe let’s put the stop around 20.50 for now.

Some of Monday’s shorts are moving away from us and I may take off PCLN and OIH unless they start to pull back. They haven’t triggered but they just aren’t setting up. Tomorrow is Friday so no charts tonight, tomorrow will be interesting. Will the bulls or bears take the hill into the weekend.

I will do a full update over the weekend and will see you in the morning.