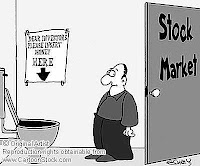

Just more misery for the bulls, but if your a trader it just doesn’t get any better than this. I was short the entire pre market interest rate cut fandango and was basically done trading for the day about when the market opened. I also “shorted” SMN later in the day for almost seven points as the basic materials just looked like they didn’t want to go down any more. I was right and lucky too.

Just more misery for the bulls, but if your a trader it just doesn’t get any better than this. I was short the entire pre market interest rate cut fandango and was basically done trading for the day about when the market opened. I also “shorted” SMN later in the day for almost seven points as the basic materials just looked like they didn’t want to go down any more. I was right and lucky too.

Interesting piece on CNBC, one of the few, that discusses why we may not be seeing classic textbook capitulation because of the advent of quants and black box trading. They also discuss why there is really no where to hide as in years past, as everything is just getting sold. The positive take away from this is that that some stocks are ridiculously cheap, and I think everything is expensive.