Conventional wisdom tells us to be short commodities in a rising interest rate environment, rates haven’t risen yet but they eventually will. Where does that leave oil?

Conventional wisdom tells us to be short commodities in a rising interest rate environment, rates haven’t risen yet but they eventually will. Where does that leave oil?

Daryl Jones over at Hedgeye did a brief but very interesting analysis:

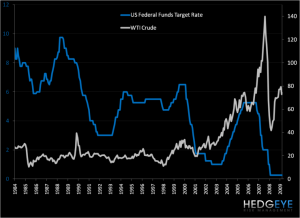

Below we’ve charted oil versus the fed funds rate going back almost 30-years. Our immediate reaction is that the tightening of fiscal policy would be negative for the price of oil, and most commodities. The chart actually tells a slightly different story.

In our date set there are three key period of tightening fiscal policy. They are as follows:

-From 11/28/1986 to 6/3/1989, the Fed Funds Target Rate was increased from 5.875% to 9.625%, which is an increase of 375 basis points. Over the same time period, oil increased in price from $15.00 per barrel to $19.90 per barrel, which is an increase of 32%;

-From 1/31/1994 to 7/31/1995, the Fed Funds Target Rate was increased from 3.0% to 6.0%, which is an increase of 300 basis points. Over the same time period, the price of oil increased from $15.19 per barrel to $17.40 per barrel, which is an increase of 15.4%; and finally

-From 5/31/2004 to 8/31/2007, the Fed Funds Target Rate was increased from 1.0% to 5.25%, which is an increase of 425 basis points. Over the same time period, oil almost doubled in price going from $39.88 per barrel to $74.40 per barrel.

This is obviously a very simplistic analysis that is based on one factor, the Fed Funds Target Rate. But the last 30-years of history definitely implies that a decline in the price of oil over the duration of an increase in interest rates, or any tightening of fiscal policy, is far from a foregone conclusion. In fact, history suggests just the opposite–that the price of oil will increase. Clearly, though, underlying GDP growth in these periods is another primary determinant and oil price should only slow when an interest rate increase begins to meaningfully slow global growth.