Dow: -173.35…

Nasdaq: -54.25… S&P: -23.14…

The big Jackson Hole shindig is this week. Kinda like our version of the Davos Switzerland meetup where all the charlatans fly in on their Gulfstreams and tell the world what’s good for them. Its called the “economic policy symposium” there in Wyoming and the proceedings include papers, commentary, and discussion.

The Federal Reserve Bank of Kansas City hosts dozens of central bankers at this lovefest, policymakers, academics, and economists from around the world are all in attendance. They eat, drink and fish a lot while we traders and investors wait with bated breath to see if it will all play to the bulls or the bears.

It’s tough fighting the desire to get long some things here. I’ve watched a couple of names that I liked pop nicely over the last two days, maybe I will acquiesce and nibble a little tomorrow. My gut says the Fed won’t wreck things, because the world is watching and they want to look accommodative as it relates to rates. If there is even a hint of hawkishness, this market will flip upside down and they know it.

There will come a point where the Fed’s toolbox is empty and that’s when the market will take no prisoners and sell everything.

Just look at the European markets They are in a NEGATIVE rate scenario for the most part and their stocks, banks and etf’s are imploding. Hasn’t helped. Look at EUFN, EWI, EWG, EWP, EWQ over the last two years. And that performance is with much lower (negative) rates.

Seventeen countries have inverted yield curves and another eight have flat curves. This is a serious warning. This is not going to be solved by more easing, because it is caused by excess easing.

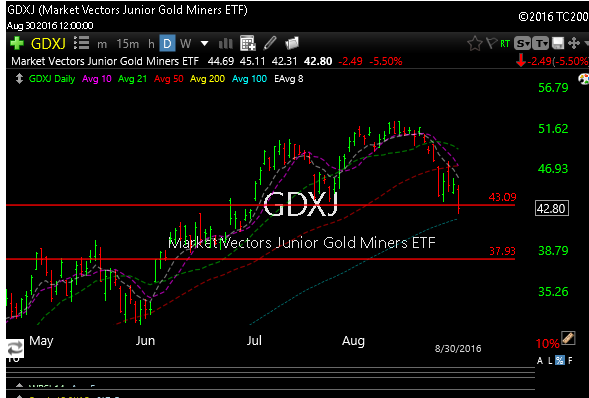

This whole narrative, however, will play to the gold and silver and miners, or it least it should, and that’s where I am weighted right now. It won’t play well for financials.

Check out the bullish patterns on GDX and GDXJ (junior miners).

If we resolve China that would change a lot of things, but for now, you cant count on that. If I let myself drown in all the negative macro stuff I would never buy a stock again, so watching volume and price action is key here. It is tough to block out all the white noise. With all this said, I’m still leaning more bullish than bearish short term.

I’m not sure when the fat lady sings, but I bet she’s having her last few meals at the Golden Corral buffet table before she takes the stage. She a slow eater, so it could still be a while.

Be ready.

P.S. Some China stocks have popped out of very oversold conditions. See WB and SINA. Both may develop bull flags in the days ahead.

Two special situation names that are percolating bullishly include AMRS and AVTR.

The asset managers look horrible, see BEN and FII. I will do a post on these tomorrow.

Have a great night.