North Korea didn’t nuke the joint over the weekend so stocks had a nice relief rally and put on a show. The Dow popped 257 points +1.1%, the S&P was +1.1%, Russell +1.03% and the Nasdaq popped 1.15%.

Most sectors were very green today with the exception of recent leading sectors like gold, silver and other metals and mini g groups.

GLD was -1.4%, SLV -1.3%, GDX was -2.4% and XME was -0.4%. These groups have had big moves of late as you know, so profits were taken.

The dollar was stronger and interest rates rose, so things may be getting interesting on that front.

I told you guys to keep an eye on energy last week because the worm may be turning in that sector. XLE put in another positive day today as you can see in the chart below, it is flagging right at key downtrend resistance. A breakout with volume above this downtrend could set off a silly short squeeze.

The energy sector (XLE) really does kind of need oil to be trending up for a breakout I would imagine and oil is just chopping around lately, so I”m not sure how significant a move XLE can make without oil moving up convincingly through 50, but XLE does look pretty bullish to me. The breakout of that downtrend on volume would validate my thinking and make me feel better.

My drug of choice is ERX when playing the energy sector. ERX gives you 3X the move of XLE, just in case you are not familiar.

My suggestion on this trade is as follows, and this is how I will play it. I am going to add this as a new long tonight on the P&L sheet.

The breakout zone for ERX is the 25.10 level. If it gets there tomorrow, I would buy half of what you normally would put into an idea at around that price.

Why half? Sometimes obvious looking breakout patterns fail on the first try and they will pull back. It’s good to keep your powder dry for the pullback.

The other reason I am approaching this more conservatively is that every time XLE gets to this break out level lately, it has failed, although this time it does look different. We’ll just have to see. If it does fail miserably again, then you only have a half position at risk.

So go with the half position at that price level (25.10), I will analyze the action and I will send you an email alert about when you should add the other half, if at all.

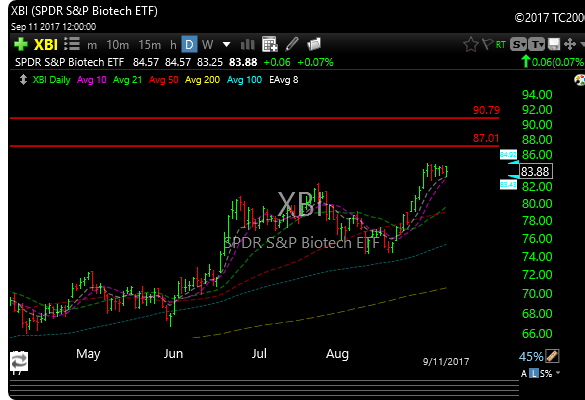

Regarding biotech, XBI continues to flag bullishly and I think it’s incubating for the next move up.