Well, my theory that the metals & mining (XME) and the gold miners (GDX) could get going kinda happened today after a couple of weeks of solid “building” action.

It was quite an eclectic grouping of sectors that made moves today, as biotech also had an enormous day after the bullish news hit that Gilead (GILD) bought KITE in an “all cash” deal. Biotech needed a decent M&A deal to goose things and they got it today.

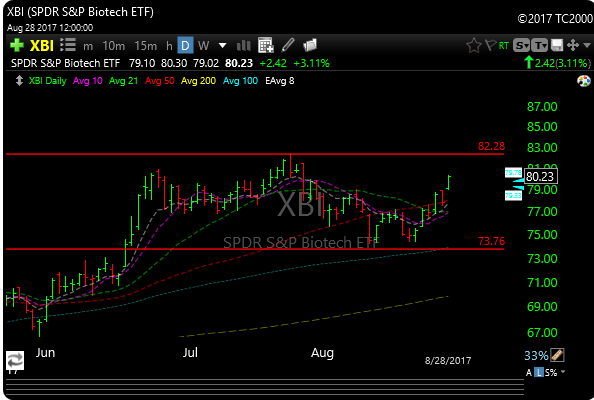

XBI closed the day on the highs going away and was +3.1% XBI is now just a couple of points away from the highs printed back on July 25. Our portfolio position LABU moved almost 10% today. Volume was the best in over a month. LABU looks like it wants 75-76 now. XBI look like 83 now.

LOXO, our other position popped +6% today. AKAO continues to act better of late and moved +3.3% today.

XBI and IBB continue to look incredibly bullish and I think some shorts in the bio space had a bit of a come to Jesus episode today. They are still short some of these names and days like today gets them running for mama.

Also, take a look at SBIO (Alps Medical Breakthrough etf) which broke out +3.7% today. There are 46 biotech stocks in this etf and they were juking today. Not many folks watch this one, I watch it all the time. It’s a good tell on bio risk appetite.

Also, see biotech etf CNCR ( Loncar Cancer Immunotherapy etf). If you play biotech and aren’t following these two etf’s, you should. They are thin but they measure appetite.

XME popped +1.6% today. It’s approaching a downtrend line breakout (green line) and lateral resistance which is about a buck higher (red line). We have seen seven days of positive action with decent volume.

GDX was even more impressive as it popped +3.6% and ripped up and through that downtrend line that I talked last week and in last nights video. it was also the best volume day since the beginning of June.

Is steel next? Keep your eye on SLX which might be trying to pull off a triple top breakout.

I highlighted CDE in last nights video and I added as a swing long today at 8.43. CDE is trying to pop above a wicked long downtrend line and it kissed it today on better volume.

Good luck.

Premium subscriptions available here.

$IBB, $XBI, $XME, $GDX, $LOXO, $GILD, $KITE, $CNCR, $SBIO, $CDE $SLX