The weekend came and went without any major developments on the North Korean front, allowing investors to breathe a sigh of relief and launch another ‘buy-the-dip’ campaign on Monday. U.S. Treasuries began the week on a lower note, giving back a portion of their gains from the end of last week. The retreat took place amid improved risk tolerance, as the weekend saw no additional escalation of tension between U.S. and North Korea. Reports from the past two days suggest that the U.S. and China are still trying to exert influence on the hermit nation through diplomacy. China announced it will stop importing North Korean coal, iron ore, and fish, while Joint Chiefs of Staff chairman Joseph Dunford arrived in South Korea on Sunday and plans to meet with representatives from Japan and China in the next few days.

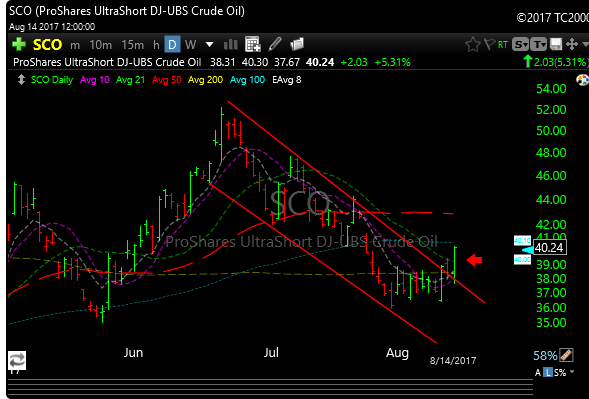

Here is a look at what oil did today, as you can see it flirted with that 50 zone only to be rejected. My gut was bearish on oil at 50 but I didn’t short it. API data will be released tomorrow at 4:30 pm and EIA data will be released Wednesday morning.

The EIA said that it expects oil production to increase by 117,000 barrels a day–to a total of 6.149 million barrels a day–in September. The EIA report has shown an increase in shale-oil production every month this year. This isn’t bullish date for oil.

SCO (short oil) had a good day today and popped convincingly out of that falling wedge pattern.

As you can see below, XLE has failed miserably since trying to poke out above lateral resistance back at the very end of July.

Oil service (OIH) is rolling over and could go even lower

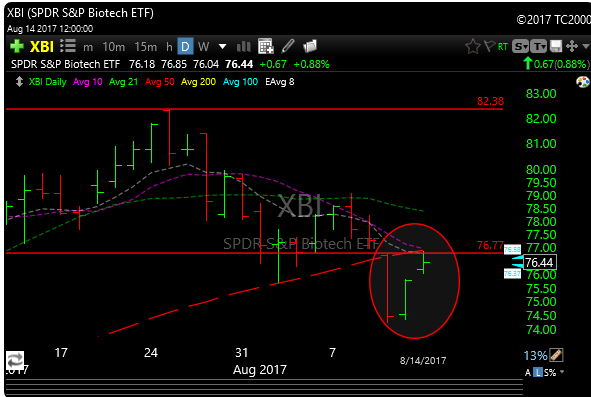

Even though we saw nice moves out of portfolio positions SGMO ad ONCE today, IBB and XBI are still struggling to take back their 50-day moving averages. As you can see below, XBI had trouble. It would be good for the bio- bulls to get a close back above that 50-day simple moving average.

See you in the morning.