Dow: -8.02…

Nasdaq: +1.97… S&P: -0.13…

It was as dull as ditchwater today. Volumes are down big, so the only thing that seems to get you action in stocks is whether or not your stock gets some news. Although it is earnings season again so that should prevent us all from sleeping at the wheel during market hours.

One such name was Netflix which reported great numbers even though this is historically their worst quarter. The stock is up about 17 points in after market trading.

PBYI, one of our holdings, got FDA approval on a breast cancer drug and it popped as high as 96 after hours but has now come down to earth to about 92. we’ll see where she goes tomorrow.

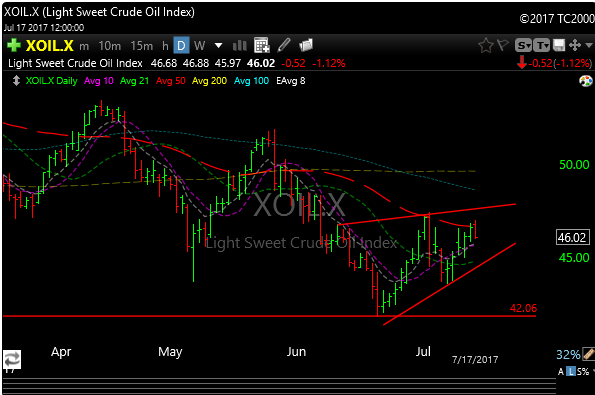

Moving over to energy, it looks sickly again after the bullish drawdown number last week. Both XLE and crude itself look suspect here. I may be interested in getting short crude via SCO soon. I will let you know.

Notice the XLE chart below. The etf hasn’t closed over the 50-day moving average since January and the most recent attempts (three of them), to get above it (green arrows), have been rejected. This isn’t good, and maybe short is the way to be until it can close above that moving average.

Oil also has its issues. You can see in the chart below that crude oil has also been rejected about four times in the last couple of weeks at that declining 50- day moving average. A move down to 40-41 wouldn’t surprise me at all on crude. It appears to be in a bearish wedge formation too.

I will be looking for a possible break lower in energy. Let’s see if we get it.