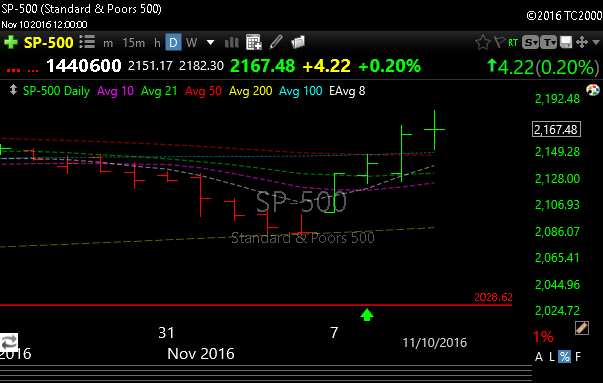

That red line in the chart above was tagged in the wee hours on election night. Roughly 2028 was the overnight low. We closed today at 2167. So we have rallied about 140 handles since futures went limit down and the world as we know it was coming to an end.

We now find ourselves about 25-30 points from new all time highs in the SPX. Today the Dow 30 made new all time highs and the Russell 2000 is damn close. It all happened very fast.

The Nasdaq is getting tortured, as it just wont go up and only goes down. Based on this appetite for stocks though, I’m not sure that weakness will last long, as bargain hunters will be looking for laggards while everything else starts to get stretched and “overbought” again. Technically, with the obvious exception of Nasdaq, things are close to giving overbought readouts. Not yet, but close.

I’ve been doing this forever and it all only seems to get weirder. I still stand by my theory that we can keep going higher into years end, but I surely would like a pullback to get long so I don’t feel like a reckless neophyte just chasing stocks. That is absolutely no way to trade.

My three new longs couldn’t look worse (I’m not used to this treatment) and I feel like the market “saw me coming” so to speak, on all three of them. I speak of TWLO, REN and AMBR. It sucks when the market is making new highs and your stocks cant get out of their own way, but I remain positive and I will be rewarded. It happens.

I lowered the stop on REN because it was being walked down on light volume and my original stop was close to lateral support so I lowered it a bit. The stock is digesting a $750 million shelf offering and a small secondary, so its belching its way along here like a drunk in traffic. For now, the daily chart is still spectacular in my eyes and I wanted to stay in the trade. That could of course change, but for now I remain long….and hopeful.

TWLO acts like a brat here. If the Nasdaq can ever catch a counter-trend rally (it will) it should be fine. Same with AMBR, and today it held moving average support, so lets just hope for kinder and gentler treatment of these three names.

NEW LONG-CBI

If an infrastructure play is your thing then you will like this one. CBI has been taken out behind the barn and whipped silly. They just reported earnings too, and the number was OK, so we don’t have to worry abut that “event” for a while. Construction & Steel plays are working and CBI is approaching a massive downtrend line breakout that goes back to April 2014. If you are a Warren Buffett disciple, then you may know that he has been gagging on this one all the way down. He has quite a big position. I have targets of 35-40 going forward.

Buy range tomorrow 30.50-31.50

See you in the morning.