Dow: -144.05…

Nasdaq: -37.00… S&P: -13.90…

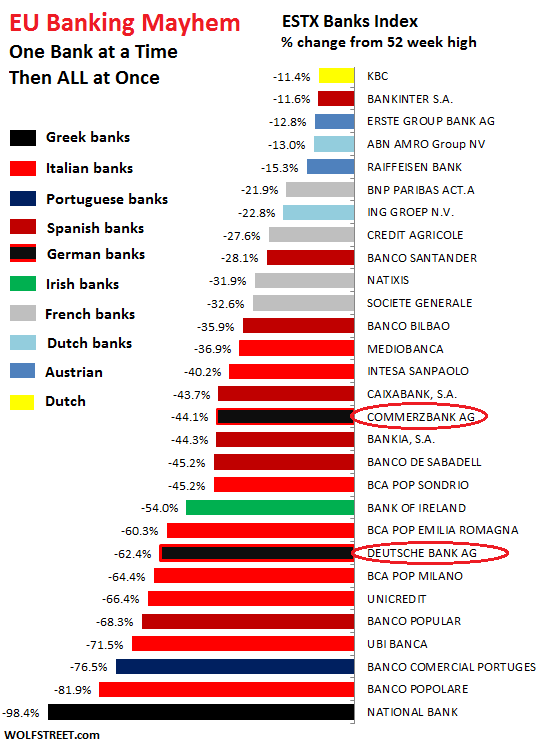

The problems at DB seem to be getting worse, or at the very least getting more serious attention from Wall St. Right now buzz phrases like “contagion” and “counter-party risk” are just starting to be mentioned. Not full steam yet, but if Euro banks get any worse, you will start to hear references to Lehman and Bear Stearns in a big way.

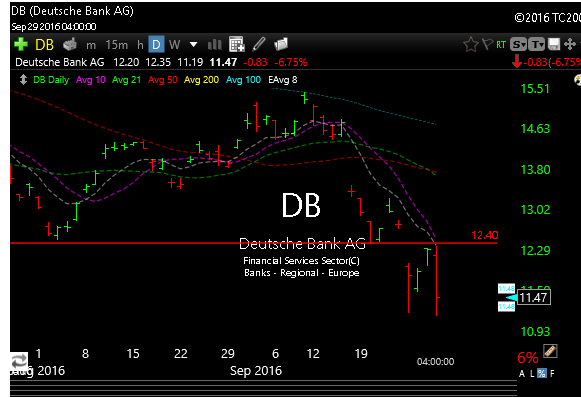

DB ws lower by almost 7% after reports that clients are reducing collateral on trades; and that about ten hedge funds have reduced exposure to the name.

European ef’s were down big and European banks got crushed. Good for EUFN so far.

These fears turned markets lower today and it turned traders to a risk off mentality. As a result, we saw some stops, and biotech got hit on a relative basis. Biotech is usually the first to go when things get tentative. Both IBB and XBI were both down a little over 3%. Energy XLE didn’t see any upside follow through after yesterday’s short squeeze rip. Crude though was up slightly. I don’t know if that’s because of what happened today in Europe, or because traders are starting to doubt OPEC after just one day. Maybe a little bit of both.

Regarding biotech, here is an interesting note out of RBC today.

RBC notes new poll suggests Californian voters are favoring the California Drug Price Relief Act (CDPRA) initiative, which is still not well known by the Street and could create headline risk due to what sounds like potential large price cuts for States. CDPRA initiative was placed on California’s November 8th ballot (Proposition 61), which would require state agencies like Medi-Cal to purchase prescription drugs at similar/lower prices paid by the federal VA, which is known to receive large discounts. They think a possible 2-3% EPS impact to large-caps if this initiative were passed across all 50 states, but this is more headline risk than anything. They believe Medicare exposure to US product sales range from 10-20% for VRTX, CELG,BIIB, AMGN and GILD. They estimate that GILD could face the largest sales reduction of $600M+ annually, followed byAMGN ($300M+), BIIB (~$200M), CELG (~$150M) and VRTX ($~50M). along with significant lobbying by industry, CDRPA’s intentions of reducing drug prices and saving taxpayer money sound good, but are unlikely to become a true reality

It may just be headline risk, but headline risk can screw up some fine looking charts as we saw today in the bio patch.

Things happen fast in the market. After decent action over the last week, the SPX managed to break 4 moving averages today. I’m not sure how optimistic the bulls will want to be tomorrow as we head into the weekend, so we may see some continued pressure tomorrow.

See you in the morning.