Dow: +133.47…

Nasdaq: +48.22… S&P: +13.83…

It was an interesting day on Wall St. today. S&P futures had dropped about 17 handles from their overnight highs. The SPX then rallied the first 45 minutes, retraced that move, and then went on to a 13 point rally to close near the highs for the day.

It probably took traders a while to digest and process last nights election. Anyway, it ended up being a decent day for the bulls.

Biotech saw some nice movement today. KITE started things off with a +10% move after meting an endpoint for patients with aggressive non-hodgkin lymphoma. Stocks like JUNO,BLUE and BLCM moved in sympathy. CHRS popped over 4% on positive global licencing news.

ANIP popped 4.5% announced the immediate launch of a new drug for infectious diseases.

NFLX got a price target bump to 125 by JP Morgan. ERII had a good day as it was added to the conviction by list at Iberia and it was also added as a buy at Evercore with a 23 target.

Europe still looks sickly, and the dimestore pundits are just now talking about the problems at Deutsche Bank and Commerzbank like its a new problem. Europe needs to catch itself here or it could get ugly in a hurry.

For now, I’m still seeing biotech as the sector that is offering the best setups.

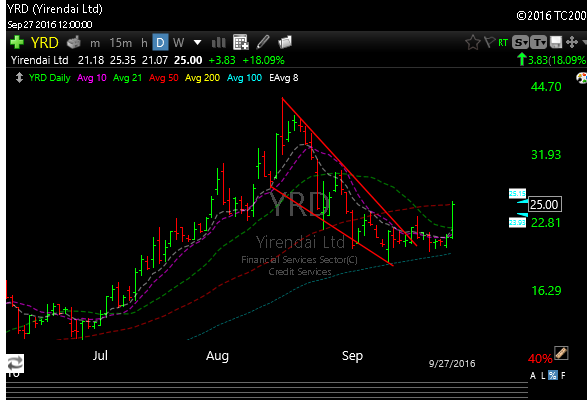

I added 2 new longs today, BLUE and YRD

BLUE was a big winner for us last year. As a matter of fact we bought it around 90 and sold it around 180. It seems that this bio space (Car-T cell therapy) is hot again (see JUNO, KITE & BLCM). I’m looking at 75 then 85 for initial targets. I added it long at around 73.75.

I also added YRD as a long. You guys know this one well. We have traded it 3x in the past for monster gains. Past performance doesn’t guarantee future results, but the set up is terrific again. I added it long today at 23.25. The stock popped 18% today with volume and all the technicals appear to be turning up.

See you in the morning.

Subscriptions here.